Question: Exercise 1-11B Differences between interest and dividends The following account balances were drawn from the financial records of Crystal Company (CC) as of January 1,

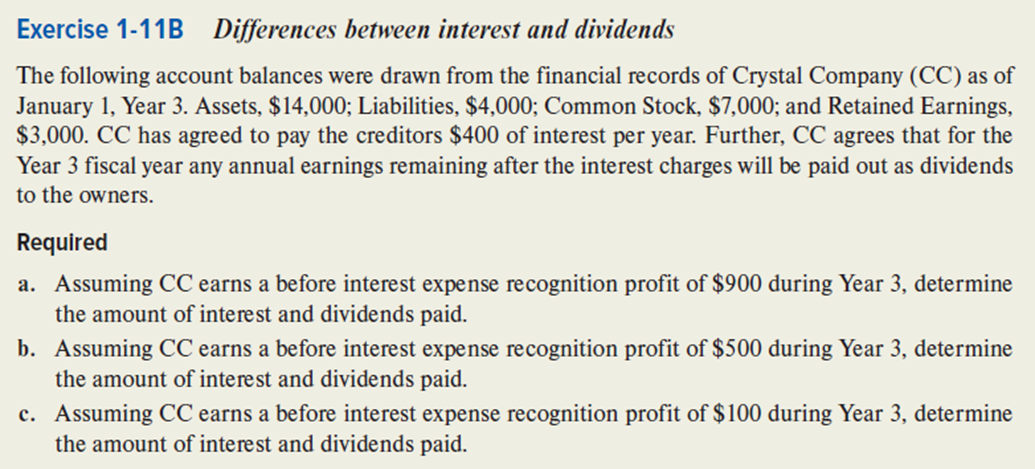

Exercise 1-11B Differences between interest and dividends The following account balances were drawn from the financial records of Crystal Company (CC) as of January 1, Year 3. Assets, $14,000; Liabilities, $4,000; Common Stock, $7,000; and Retained Earnings, $3,000. CC has agreed to pay the creditors $400 of interest per year. Further, CC agrees that for the Year 3 fiscal year any annual earnings remaining after the interest charges will be paid out as dividends to the owners. Required a. Assuming CC earns a before interest expense recognition profit of $900 during Year 3, determine the amount of interest and dividends paid. b. Assuming CC earns a before interest expense recognition profit of $500 during Year 3, determine the amount of interest and dividends paid. c. Assuming CC earns a before interest expense recognition profit of $100 during Year 3, determine the amount of interest and dividends paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts