Question: Exercise 11-3 Working with a Segmented Income Statement [LO1] Middleton Associates is a consulting firm that specializes in information systems for construction and landscaping companies.

![Exercise 11-3 Working with a Segmented Income Statement [LO1] Middleton Associates](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66e07ce408c43_06766e07ce38040e.jpg)

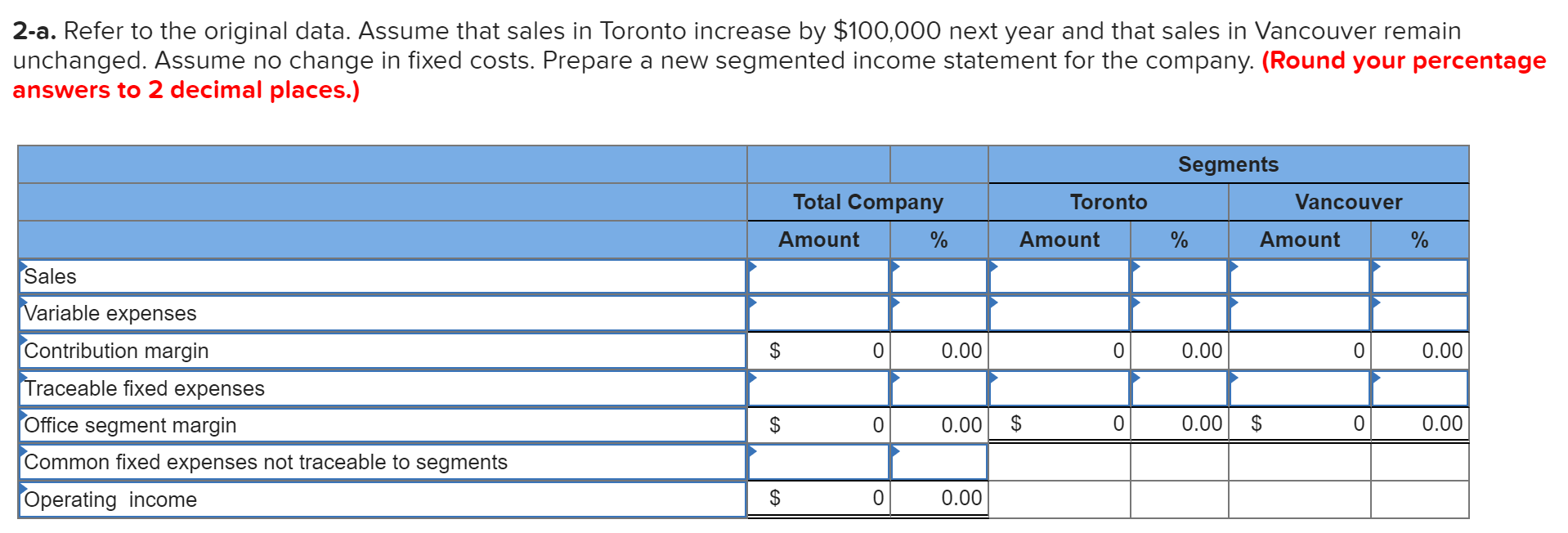

Exercise 11-3 Working with a Segmented Income Statement [LO1] Middleton Associates is a consulting firm that specializes in information systems for construction and landscaping companies. The firm has two offices-one in Toronto and one in Vancouver. The firm classifies the direct costs of consulting jobs as variable costs. A segmented contribution format income statement for the company's most recent year is given below: Sales Variable expenses Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to offices Operating income Office Total Company Toronto Vancouver $911,000 100.0% $161,000 100% $750,000 100% 452,750 49.70 40,250 25 412,500 55 458,250 50.30 120,750 75 337,500 45 172, 110 18.89 82, 110 51 90,000 12 286, 140 31.41 $ 38,640 24% $247,500 33% 180,000 19.76 $106,140 11.65% 2-a. Refer to the original data. Assume that sales in Toronto increase by $100,000 next year and that sales in Vancouver remain unchanged. Assume no change in fixed costs. Prepare a new segmented income statement for the company. (Round your percentage answers to 2 decimal places.) Segments Total Company Toronto Vancouver Amount % Amount % Amount % Sales Variable expenses $ O 0.00 0 0.00 0 0.00 | Contribution margin Traceable fixed expenses Office segment margin Common fixed expenses not traceable to segments Operating income $ 0 0.00 $ 0 0.00 $ $ 0 0.00 $ 0 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts