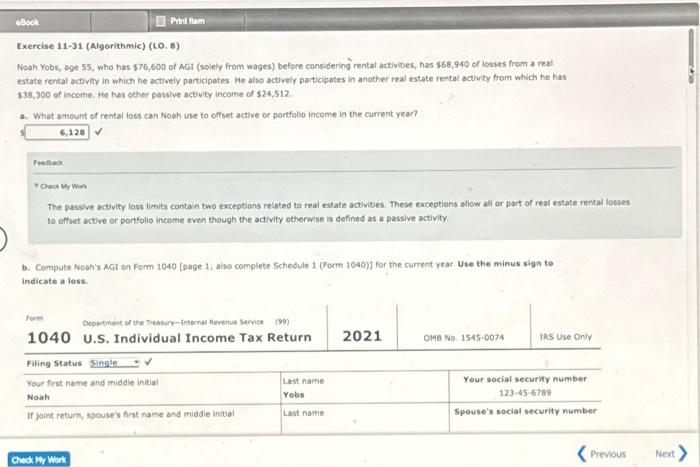

Question: Exercise 11-31 (Algorithmic) (LO, B) Noah Yobs, age 55, who has $76,600 of AGI (solely from wages) before considering rental activities, has $68,940 of losses

Exercise 11-31 (Algorithmic) (LO, B) Noah Yobs, age 55, who has $76,600 of AGI (solely from wages) before considering rental activities, has $68,940 of losses from a real estate rental activity in which he actively participetes. He also actively participates in another real estate rental activity from which he has $33,300 of income. He has other passive activity incorne of $24;512. a. What amount of rental loss can Noah use to offset active or portfolo income in the current year? 1 Festheses Fhen My Wut The passive activity loss limits contain two exceptions related to real estate activites. These exceptions allow all or part of real estate rental losses to oftset active or portfolio income even though the activity otherwise is defined as a passive activity b. Compute Noah's AGI on Form 1040 [poge 1, also complete Schedule 1 (form 10s0)] for the current year Use the minus sign to indicate a loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts