Question: Exercise 11-46 Physical Quantities Method; Sell or Process Further (LO 11-8, 9) The following questions relate to Kyle Company, which manufactures products KA, KB, and

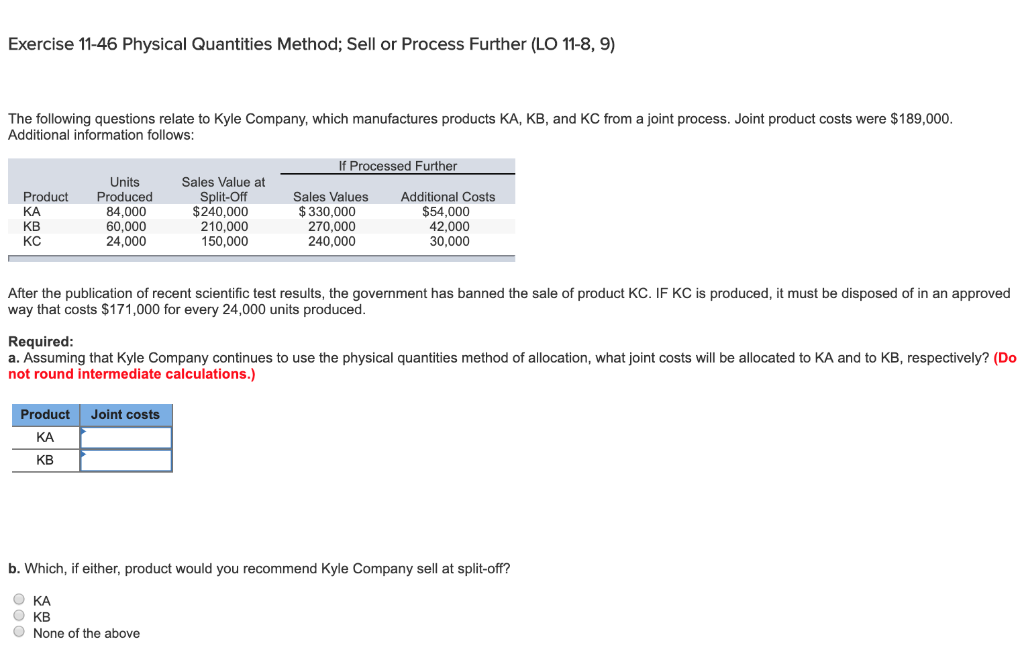

Exercise 11-46 Physical Quantities Method; Sell or Process Further (LO 11-8, 9) The following questions relate to Kyle Company, which manufactures products KA, KB, and KC from a joint process. Joint product costs were $189,000 Additional information follows: If Processed Further Units Product Produced KA KB KC 84,000 60,000 24,000 Sales Value at Split-Off $240,000 210,000 150,000 Sales Values $330,000 270,000 240,000 Additional Costs $54,000 42,000 30,000 After the publication of recent scientific test results, the government has banned the sale of product KC. IF KC is produced, it must be disposed of in an approved way that costs $171,000 for every 24,000 units produced Required a. Assuming that Kyle Company continues to use the physical quantities method of allocation, what joint costs will be allocated to KA and to KB, respectively? (Do not round intermediate calculations.) Product Joint costs KA KB b. Which, if either, product would you recommend Kyle Company sell at split-off? O KA O KB O None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts