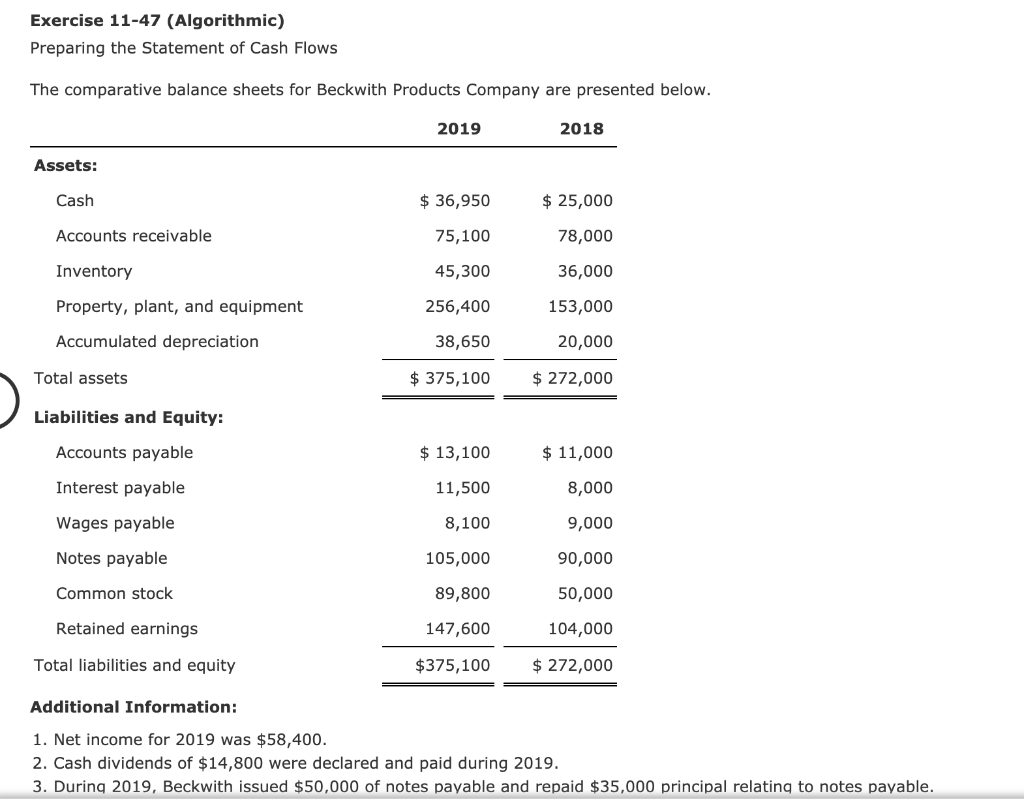

Question: Exercise 11-47 (Algorithmic) Preparing the Statement of Cash Flows The comparative balance sheets for Beckwith Products Company are presented below. 2019 2018 Assets: Cash $

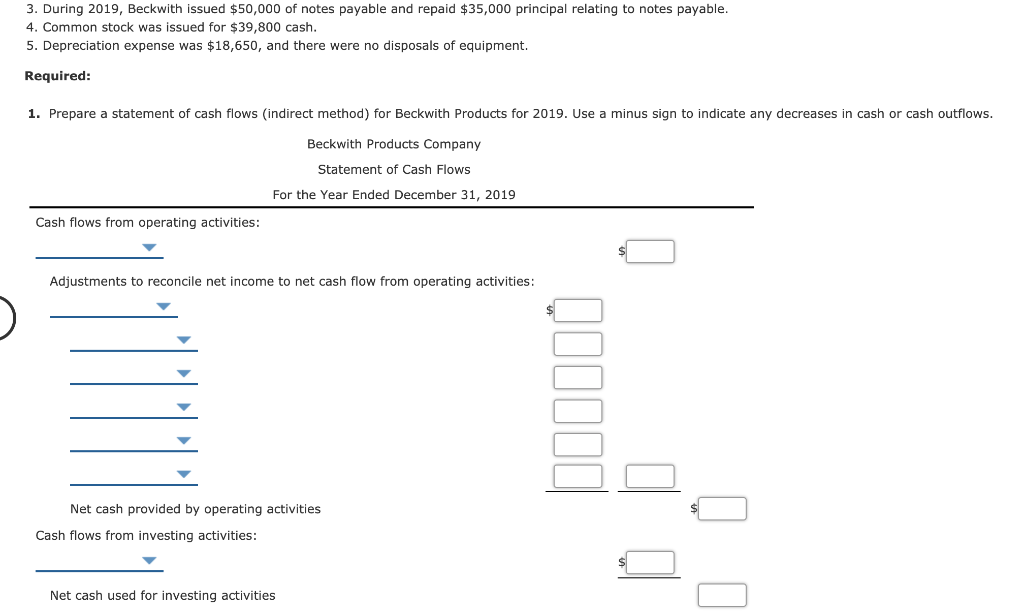

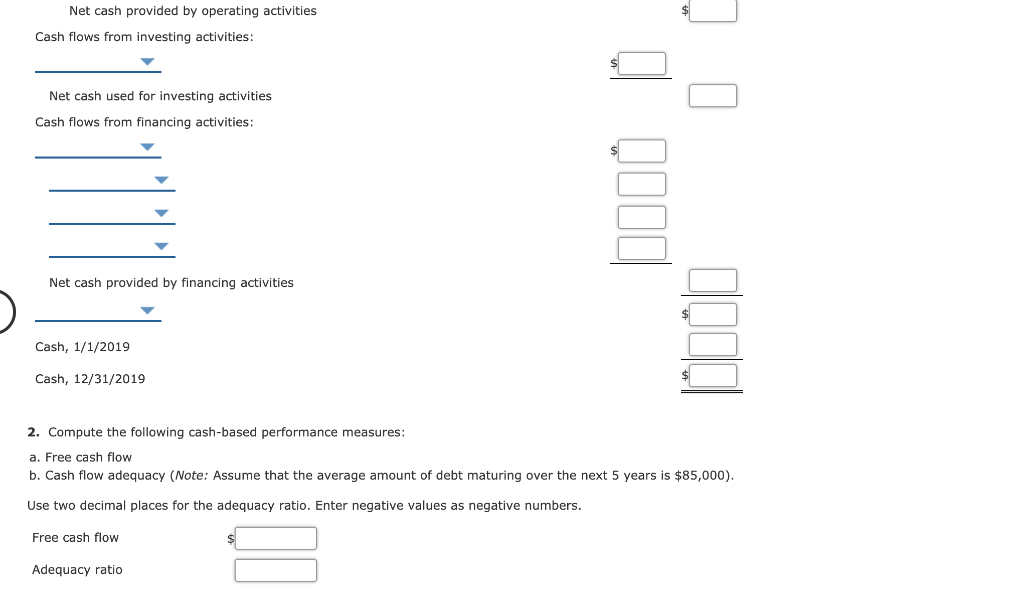

Exercise 11-47 (Algorithmic) Preparing the Statement of Cash Flows The comparative balance sheets for Beckwith Products Company are presented below. 2019 2018 Assets: Cash $ 36,950 $ 25,000 Accounts receivable 75,100 78,000 Inventory 36,000 45,300 256,400 Property, plant, and equipment 153,000 Accumulated depreciation 38,650 20,000 Total assets $ 375,100 $ 272,000 Liabilities and Equity: Accounts payable $ 13,100 $ 11,000 Interest payable 11,500 8,000 Wages payable 8,100 9,000 Notes payable 105,000 90,000 Common stock 89,800 50,000 Retained earnings 147,600 104,000 Total liabilities and equity $375,100 $ 272,000 Additional Information: 1. Net income for 2019 was $58,400. 2. Cash dividends of $14,800 were declared and paid during 2019. 3. During 2019, Beckwith issued $50,000 of notes payable and repaid $35,000 principal relating to notes payable. 3. During 2019, Beckwith issued $50,000 of notes payable and repaid $35,000 principal relating to notes payable. 4. Common stock was issued for $39,800 cash. 5. Depreciation expense was $18,650, and there were no disposals of equipment. Required: 1. Prepare a statement of cash flows (indirect method) for Beckwith Products for 2019. Use a minus sign to indicate any decreases in cash or cash outflows. Beckwith Products Company Statement of Cash Flows For the Year Ended December 31, 2019 Cash flows from operating activities: o Adjustments to reconcile net income to net cash flow from operating activities: Net cash provided by operating activities Cash flows from investing activities: o Net cash used for investing activities Net cash provided by operating activities Cash flows from investing activities: Net cash used for investing activities Cash flows from financing activities: $ Net cash provided by financing activities $ Cash, 1/1/2019 Cash, 12/31/2019 $ 2. Compute the following cash-based performance measures: a. Free cash flow b. Cash flow adequacy (Note: Assume that the average amount of debt maturing over the next 5 years is $85,000). Use two decimal places for the adequacy ratio. Enter negative values as negative numbers. Free cash flow Adequacy ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts