Question: Exercise 11-51 (Algo) Physical Quantities Method (LO 11-8) The following questions relate to Kyle Company, which manufactures products KA, KB, and KC from a joint

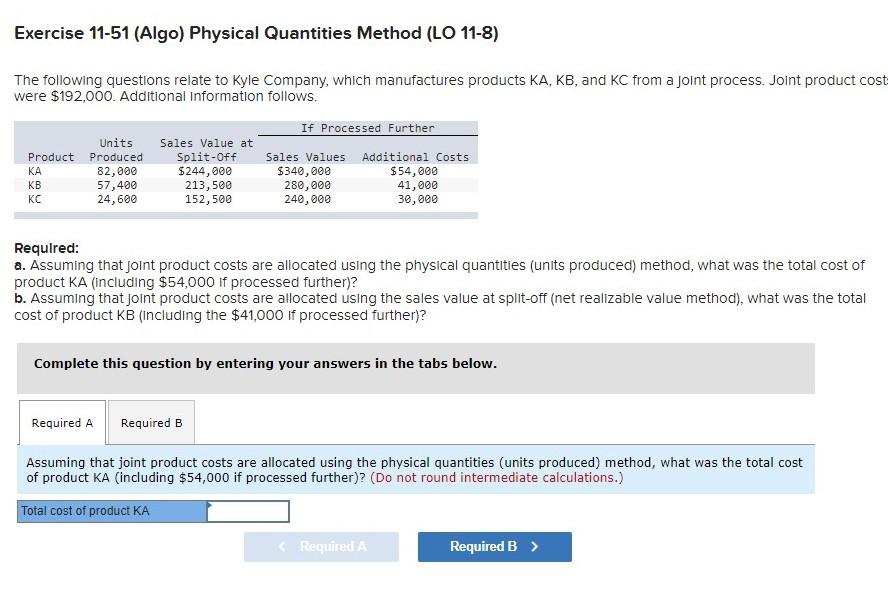

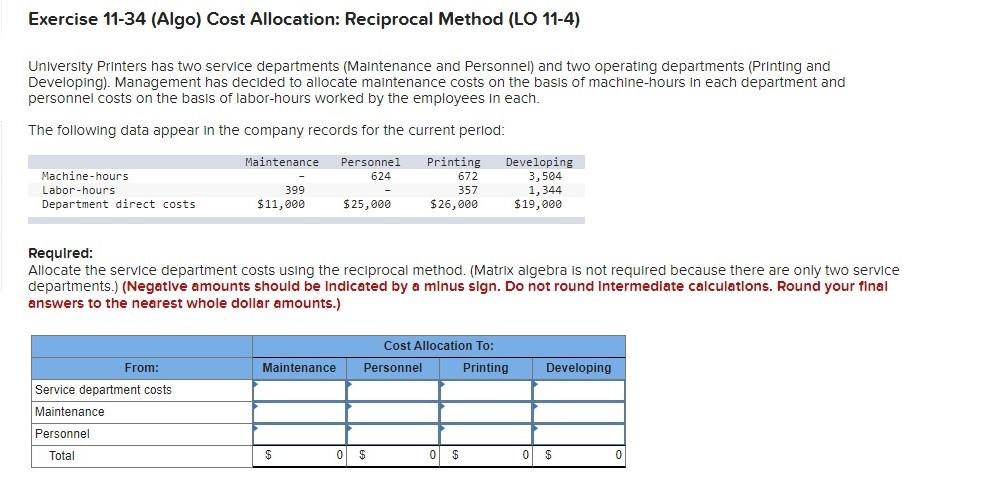

Exercise 11-51 (Algo) Physical Quantities Method (LO 11-8) The following questions relate to Kyle Company, which manufactures products KA, KB, and KC from a joint process. Joint product cost were $192,000. Additional Information follows. If Processed Further Units Sales Value at Product Produced Split-off Sales Values Additional Costs 82,000 $244,000 $340,000 $54,000 57,400 213,500 280,000 41,000 24,600 152,500 240,000 30,000 KA KB KC Required: a. Assuming that joint product costs are allocated using the physical quantities (units produced) method, what was the total cost of product KA (including $54,000 if processed further)? b. Assuming that joint product costs are allocated using the sales value at split-off (net realizable value method), what was the total cost of product KB (including the $41,000 if processed further)? Complete this question by entering your answers in the tabs below. Required A Required B Assuming that joint product costs are allocated using the physical quantities (units produced) method, what was the total cost of product KA (including $54,000 if processed further)? (Do not round intermediate calculations.) Total cost of product KA Required A Required B > Exercise 11-34 (Algo) Cost Allocation: Reciprocal Method (LO 11-4) University Printers has two service departments (Maintenance and Personnel) and two operating departments (Printing and Developing). Management has decided to allocate maintenance costs on the basis of machine-hours in each department and personnel costs on the basis of labor-hours worked by the employees in each The following data appear in the company records for the current period: Maintenance Personnel 624 Machine-hours Labor-hours Department direct costs 399 $11,000 Printing 672 357 $ 26,000 Developing 3,504 1,344 $19,000 $ 25,000 Required: Allocate the service department costs using the reciprocal method. (Matrix algebra is not required because there are only two service departments.) (Negative amounts should be Indicated by a minus sign. Do not round Intermediate calculations. Round your final answers to the nearest whole dollar amounts.) Cost Allocation To: Personnel Printing Maintenance Developing From: Service department costs Maintenance Personnel Total $ 0 $ 0 $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts