Question: Exercise 11-6 Profit allocation LO3 excel CHECK FIGURES: 1. Share of profit: Liam: $126,750; Katano: $(96,750) Liam and Katano formed a partnership to open a

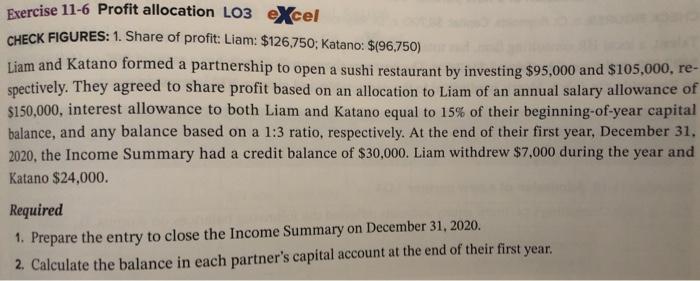

Exercise 11-6 Profit allocation LO3 excel CHECK FIGURES: 1. Share of profit: Liam: $126,750; Katano: $(96,750) Liam and Katano formed a partnership to open a sushi restaurant by investing $95,000 and $105,000, re- spectively. They agreed to share profit based on an allocation to Liam of an annual salary allowance of $150,000, interest allowance to both Liam and Katano equal to 15% of their beginning-of-year capital balance, and any balance based on a 1:3 ratio, respectively. At the end of their first year, December 31, 2020, the Income Summary had a credit balance of $30,000. Liam withdrew $7,000 during the year and Katano $24,000. Required 1. Prepare the entry to close the Income Summary on December 31, 2020. 2. Calculate the balance in each partner's capital account at the end of their first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts