Question: Exercise 1-16 (Static) Computing net income using accounting equation LO P2 Shep Company's records show the following information for the current year. Total assets Total

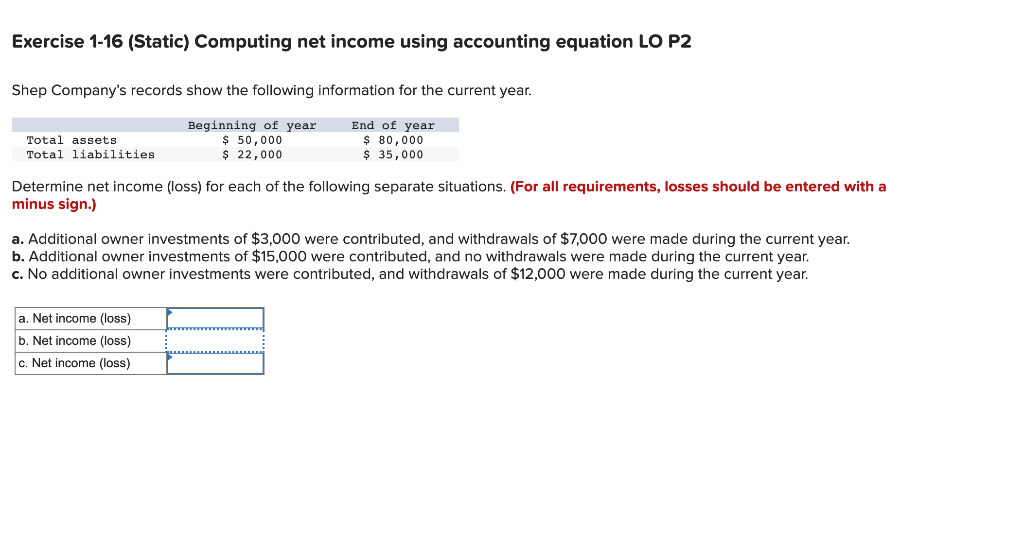

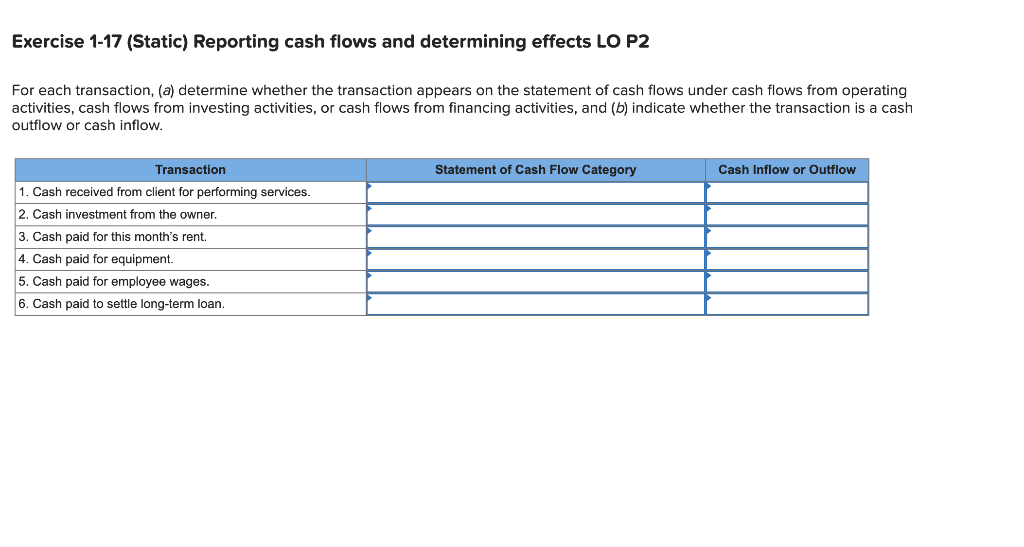

Exercise 1-16 (Static) Computing net income using accounting equation LO P2 Shep Company's records show the following information for the current year. Total assets Total liabilities Beginning of year $ 50,000 $ 22,000 End of year $ 80,000 $ 35,000 Determine net income (loss) for each of the following separate situations. (For all requirements, losses should be entered with a minus sign.) a. Additional owner investments of $3,000 were contributed, and withdrawals of $7,000 were made during the current year. b. Additional owner investments of $15,000 were contributed, and no withdrawals were made during the current year. c. No additional owner investments were contributed, and withdrawals of $12,000 were made during the current year. a. Net income (loss) b. Net income (loss) c. Net income (loss) Exercise 1-17 (Static) Reporting cash flows and determining effects LO P2 For each transaction, (a) determine whether the transaction appears on the statement of cash flows under cash flows from operating activities, cash flows from investing activities, or cash flows from financing activities, and (b) indicate whether the transaction is a cash outflow or cash inflow. Statement of Cash Flow Category Cash Inflow or Outflow Transaction 1. Cash received from client for performing services. 2. Cash investment from the owner, 3. Cash paid for this month's rent, 4. Cash paid for equipment. 5. Cash paid for employee wages. 6. Cash paid to settle long-term loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts