Question: Exercise 11-6 Your answer is partially correct. Try again. Sweet Company purchased equipment for $216,240 on October 1, 2017. It is estimated that the equipment

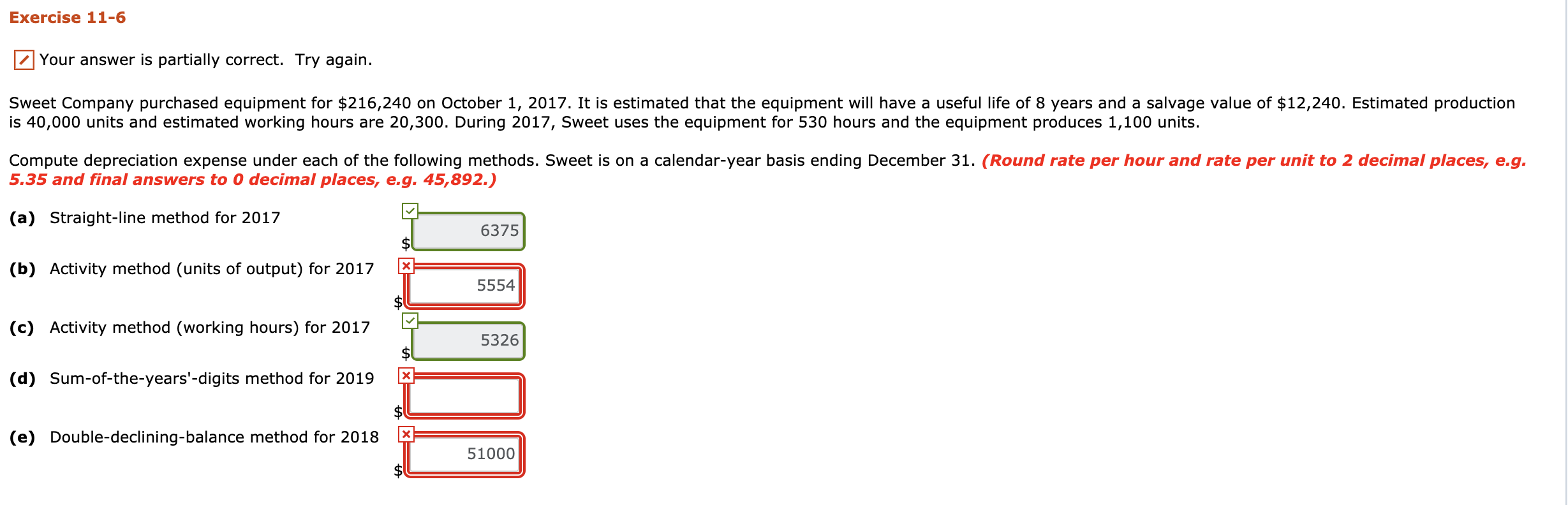

Exercise 11-6 Your answer is partially correct. Try again. Sweet Company purchased equipment for $216,240 on October 1, 2017. It is estimated that the equipment will have a useful life of 8 years and a salvage value of $12,240. Estimated production is 40,000 units and estimated working hours are 20,300. During 2017, Sweet uses the equipment for 530 hours and the equipment produces 1,100 units. Compute depreciation expense under each of the following methods. Sweet is on a calendar-year basis ending December 31. (Round rate per hour and rate per unit to 2 decimal places, e.g. 5.35 and final answers to 0 decimal places, e.g. 45,892.) (a) Straight-line method for 2017 6375 (b) Activity method (units of output) for 2017 X 5554 (c) Activity method (working hours) for 2017 5326 (d) Sum-of-the-years'-digits method for 2019 X (e) Double-declining-balance method for 2018 51000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts