Question: EXERCISE 11-6A Exercise 11-6A Accounting for cumulative preferred dividends When Crossett Corporation was organized in January, Year 1, it immediately issued 4,000 shares of $50

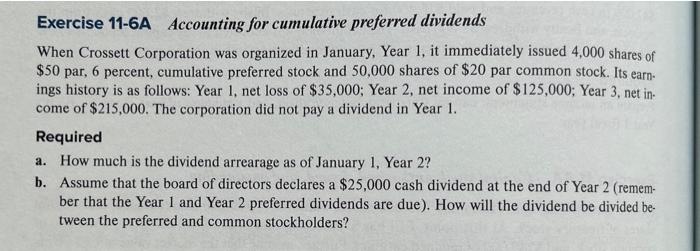

Exercise 11-6A Accounting for cumulative preferred dividends When Crossett Corporation was organized in January, Year 1, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its earnings history is as follows: Year 1 , net loss of $35,000; Year 2 , net income of $125,000; Year 3, net income of $215,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2 ? b. Assume that the board of directors declares a $25,000 cash dividend at the end of Year 2 (remem. ber that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided be. tween the preferred and common stockholders? Exercise 11-6A Accounting for cumulative preferred dividends When Crossett Corporation was organized in January, Year 1, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its earnings history is as follows: Year 1, net loss of $35,000; Year 2, net income of $125,000; Year 3, net income of $215,000. The corporation did not pay a dividend in Year 1 . Required a. How much is the dividend arrearage as of January 1, Year 2 ? b. Assume that the board of directors declares a $25,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Exercise 11-6A Accounting for cumulative preferred dividends When Crossett Corporation was organized in January, Year 1, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its earnings history is as follows: Year 1, net loss of $35,000; Year 2, net income of $125,000; Year 3, net income of $215,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2 ? b. Assume that the board of directors declares a $25,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Exercise 11-6A Accounting for cumulative preferred dividends When Crossett Corporation was organized in January, Year 1, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its camings history is as follows: Year 1, net loss of $35,000; Year 2, net income of $125,000; Year 3, net income of $215,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1 , Year 2 ? b. Assume that the board of directors declares a $25,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided be tween the preferred and common stockholders? Exercise 11-6A Accounting for cumulative preferred dividends When Crossett Corporation was organized in January, Year 1, it immediately issued 4,000 shares of $50 par, 6 percent, cumulative preferred stock and 50,000 shares of $20 par common stock. Its earn. ings history is as follows: Year 1, net loss of $35,000; Year 2, net income of $125,000; Year 3, net in. come of $215,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1 , Year 2 ? b. Assume that the board of directors declares a $25,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts