Question: Exercise 12. previous problem) to your stockholders. How would you defend your decision? How receptive will stockholders be to your defense? Would it make any

Exercise 12.

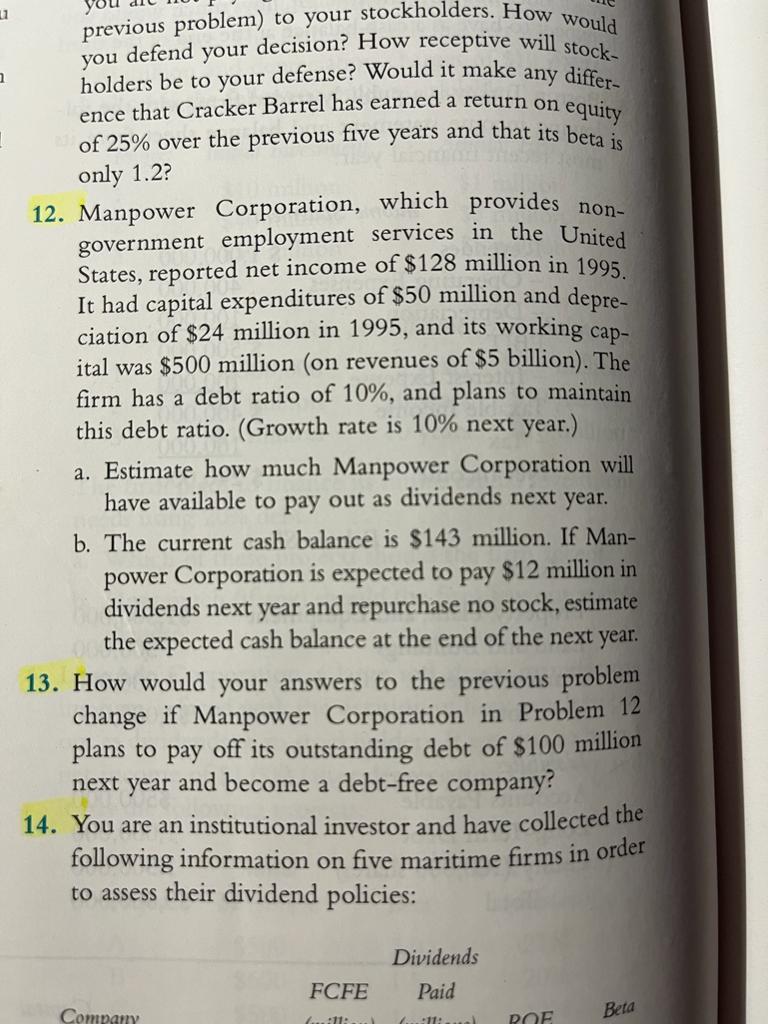

previous problem) to your stockholders. How would you defend your decision? How receptive will stockholders be to your defense? Would it make any difference that Cracker Barrel has earned a return on equity of 25% over the previous five years and that its beta is only 1.2 ? 12. Manpower Corporation, which provides nongovernment employment services in the United States, reported net income of $128 million in 1995 . It had capital expenditures of $50 million and depreciation of $24 million in 1995 , and its working capital was $500 million (on revenues of $5 billion). The firm has a debt ratio of 10%, and plans to maintain this debt ratio. (Growth rate is 10% next year.) a. Estimate how much Manpower Corporation will have available to pay out as dividends next year. b. The current cash balance is $143 million. If Manpower Corporation is expected to pay $12 million in dividends next year and repurchase no stock, estimate the expected cash balance at the end of the next year. 13. How would your answers to the previous problem change if Manpower Corporation in Problem 12 plans to pay off its outstanding debt of $100 million next year and become a debt-free company? 14. You are an institutional investor and have collected the following information on five maritime firms in order to assess their dividend policies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts