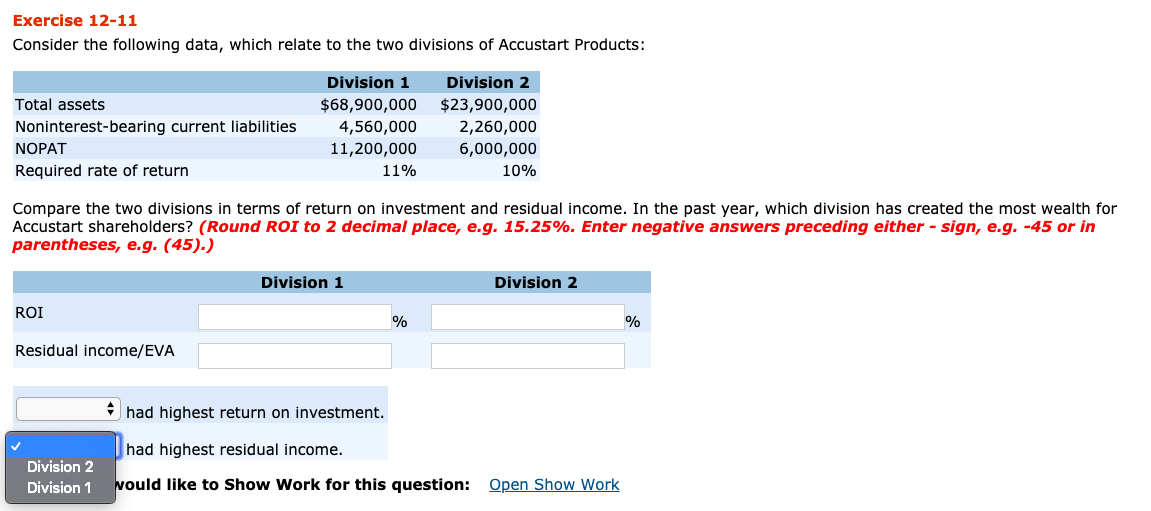

Question: Exercise 12-11 Consider the following data, which relate to the two divisions of Accustart Products: Total assets Noninterest-bearing current liabilities NOPAT Required rate of return

Exercise 12-11 Consider the following data, which relate to the two divisions of Accustart Products: Total assets Noninterest-bearing current liabilities NOPAT Required rate of return Division 1 $68,900,000 4,560,000 11,200,000 11% Division 2 $23,900,000 2,260,000 6,000,000 10% Compare the two divisions in terms of return on investment and residual income. In the past year, which division has created the most wealth for Accustart shareholders? (Round ROI to 2 decimal place, e.g. 15.25%. Enter negative answers preceding either - sign, e.g. -45 or in parentheses, e.g. (45).) Division 1 Division 2 ROI % Residual income/EVA had highest return on investment. had highest residual income. Division 2 Division 1 vould like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts