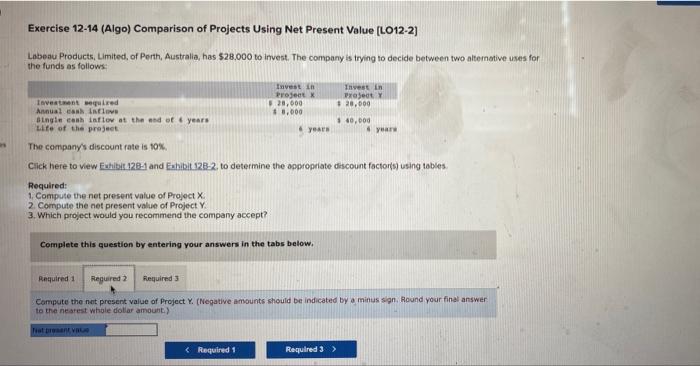

Question: Exercise 12-14 (Algo) Comparison of Projects Using Net Present Value [LO12-2] Lobeau Products, Limited, of Perth, Australia, has $28,000 to invest. The company is trying

![Exercise 12-14 (Algo) Comparison of Projects Using Net Present Value [LO12-2]](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66cda7b08bfa1_84066cda7b02c84c.jpg)

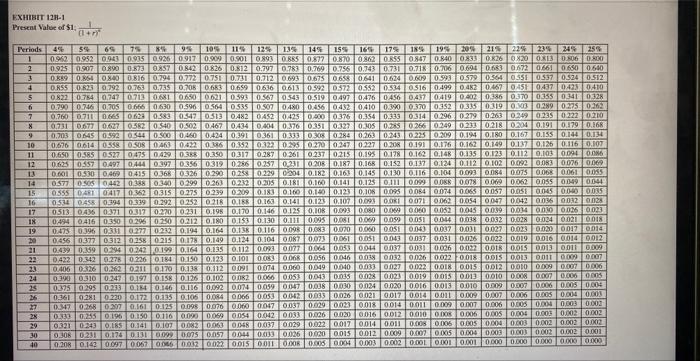

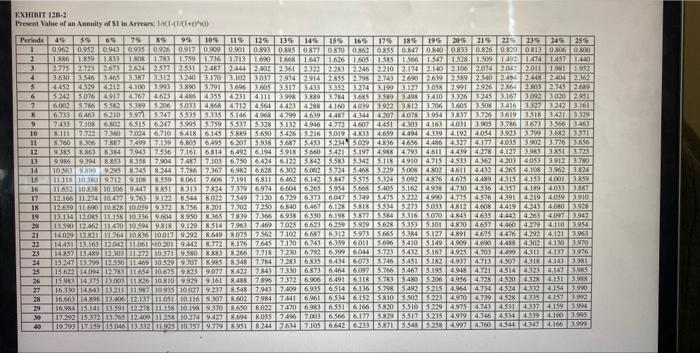

Exercise 12-14 (Algo) Comparison of Projects Using Net Present Value [LO12-2] Lobeau Products, Limited, of Perth, Australia, has $28,000 to invest. The company is trying to decide between two athernative uses for the funds as follows: The company's discount rate is 10%. Click here to view Exbibit 128-1 and Exbibit 128-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project X. 2. Compute the net present value of Project Y. 3. Which project would you recommend the company accept? Complete this question by entering your answers in the tabs below. Compute the net present value of Project X. (Negotive amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.) Exercise 12-14 (Aigo) Comparison of Projects Using Net Present Value [LO12-2] Labeau Products, Limited, of Perth, Australia, has $28,000 to invest. The company is trying to decide between two altemative ures for the funds as follows: The company's discount rate is 10%. Click here to vew Euhibit 128-4 and Eabibit.128-2, to determine the oppropriate discount factoris) using tables. Required: 1. Compute the net present value of Project X : 2 Compute the net present value of Project Y. 3. Which project would you recommend the company accept? Complete this question by entering your answers in the tabs below. Compute the net present value of Project . (Negative amounts should be indicated by a minus sign, Round your finel answer to the nearest whole dollar amount.) E.KHIBEI 12H-1 Present Vahue of $1(1+r31 FHI 12-2 Present Value of an Annuity of 51 in Arrears, tiv(-1) (1+eK=1)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts