Question: Exercise 12-15 (Static) Analyzing cash flow on total assets LO A1 A company reported average total assets of $1,240 Year 1 and $138 in Year

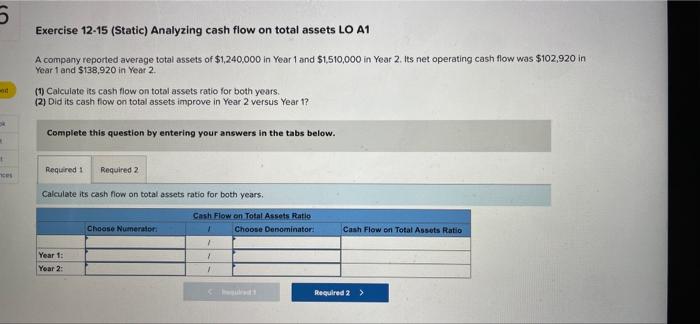

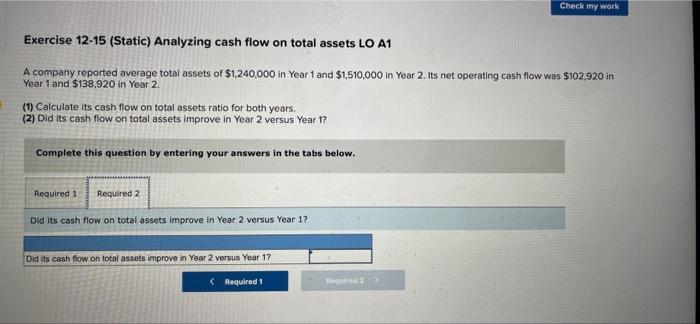

5 Exercise 12-15 (Static) Analyzing cash flow on total assets LO A1 A company reported average total assets of $1,240,000 in Year 1 and $1,510,000 in Year 2. Its net operating cash flow was $102,920 in Year 1 and $138,920 in Year 2. (1) Calculate its cash flow on total assets ratio for both years. (2) Did its cash flow on total assets improve in Year 2 versus Year 1? Complete this question by entering your answers in the tabs below. + Required 1 Toot Required 2 Calculate its cash flow on total assets ratio for both years, Choose Numerator Cash Flow on Total Assets Ratio Choose Denominator: 1 Cash Flow on Total Assets Ratio Year 1: Year 2 1 Required 2 > Check my work Exercise 12-15 (Static) Analyzing cash flow on total assets LO A1 A company reported average total assets of $1,240,000 in Year 1 and $1,510,000 in Year 2. Its net operating cash flow was $102,920 in Year 1 and $138,920 in Year 2 (1) Calculate its cash flow on total assets ratio for both years. (2) Did its cash flow on total assets improve in Year 2 versus Year 1? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Did its cash flow on total assets improve in Year 2 versus Year 1? Did its cash flow on total assets improve in Year 2 versus Year 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts