Question: Exercise 12-17 (Algorithmic) (LO, 4) In 2022, Henri, a U.S. citizen and calendar year taxpayer, reports $25,400 of income from France, which imposes a 10%

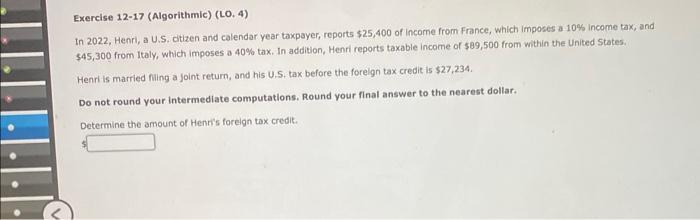

Exercise 12-17 (Algorithmic) (LO, 4) In 2022, Henri, a U.S. citizen and calendar year taxpayer, reports $25,400 of income from France, which imposes a 10% income tax, and $45,300 from Italy, which imposes a 40% tax, In addition, Henri reports taxable income of $89,500 from within the United States. Henri is married filing a joint return, and his U.S. tax before the forelgn tax credic is $27,234. Do not round your intermediate computations. Round your final answer to the nearest dollar. Determine the amount of Henri's forelgn tox credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts