Question: Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption for the following taxpayers. If an amount is zero, enter O. Click here to access the

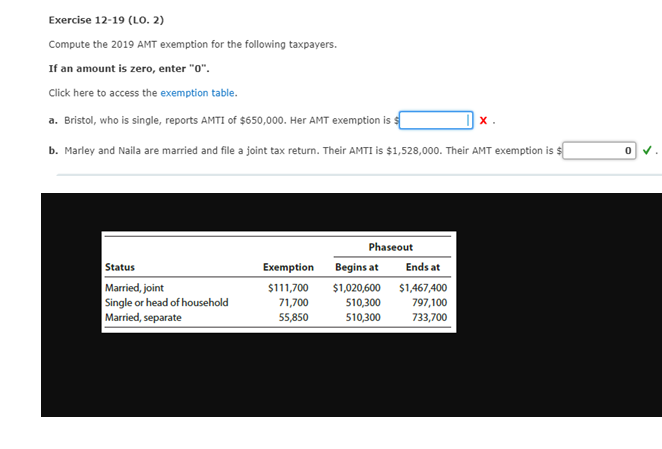

Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption for the following taxpayers. If an amount is zero, enter "O". Click here to access the exemption table. a. Bristol, who is single, reports AMTI of $650,000. Her AMT exemption is s x . b. Marley and Naila are married and file a joint tax return. Their AMTI is $1,528,000. Their AMT exemption is $ Status Married, joint Single or head of household Married, separate Exemption $111,700 71,700 55,850 Phaseout Begins at Ends at $1,020,600 $1,467,400 510,300 797,100 5 10,300 733,700 Exercise 12-19 (LO. 2) Compute the 2019 AMT exemption for the following taxpayers. If an amount is zero, enter "O". Click here to access the exemption table. a. Bristol, who is single, reports AMTI of $650,000. Her AMT exemption is s x . b. Marley and Naila are married and file a joint tax return. Their AMTI is $1,528,000. Their AMT exemption is $ Status Married, joint Single or head of household Married, separate Exemption $111,700 71,700 55,850 Phaseout Begins at Ends at $1,020,600 $1,467,400 510,300 797,100 5 10,300 733,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts