Question: Exercise 12-2 Your answer is partially correct. Try again. enek Corporation had the following transactions pertaining to debt investments. 1. Purchased 64 9%, $2,000 Leeds

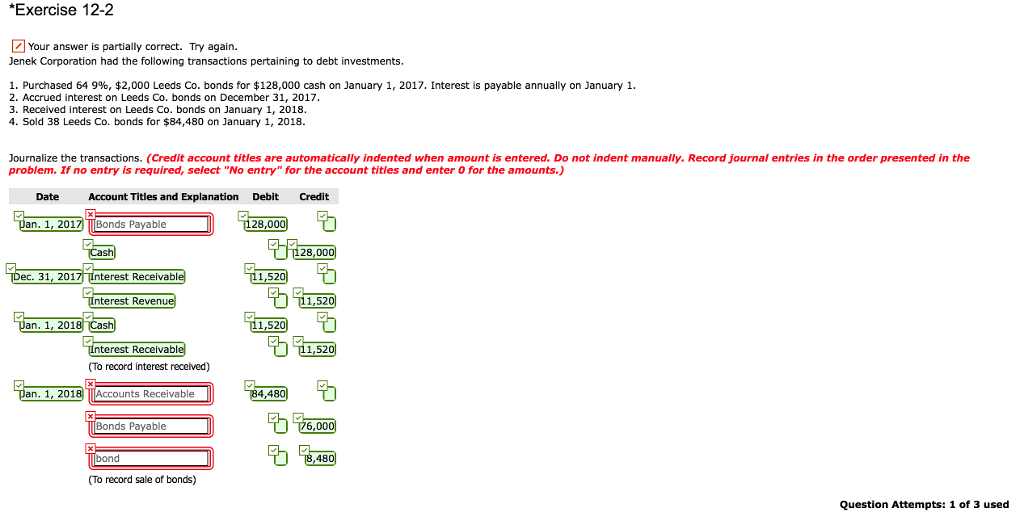

Exercise 12-2 Your answer is partially correct. Try again. enek Corporation had the following transactions pertaining to debt investments. 1. Purchased 64 9%, $2,000 Leeds Co. bonds for $128,000 cash on January 1, 2017. Interest is payable annually on January 1. 2. Accrued interest on Leeds Co. bonds on December 31, 2017 3. Received interest on Leeds Co. bonds on January 1, 2018 4. Sold 38 Leeds Co. bonds for $84,480 on January 1, 2018 ournalize the transactions. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit an. 1, 2017 Bonds Payable 128,000 ?? 128,000 TDec. 31, 2017 Interest Receivable 11,520 11,520 nterest Re sh 11,52 nterest Receivab 1,520 To record interest received) an. 1, 2018 Accounts Receivable 4,4 Bonds Payable 6,000 bond (To record sale of bonds) Question Attempts: 1 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts