Question: Exercise 12-20 (Algorithmic) Amortized Cost Model Mahco Financial began operations in 2018 and invests in bonds to be held to maturity. On January 1, 2018,

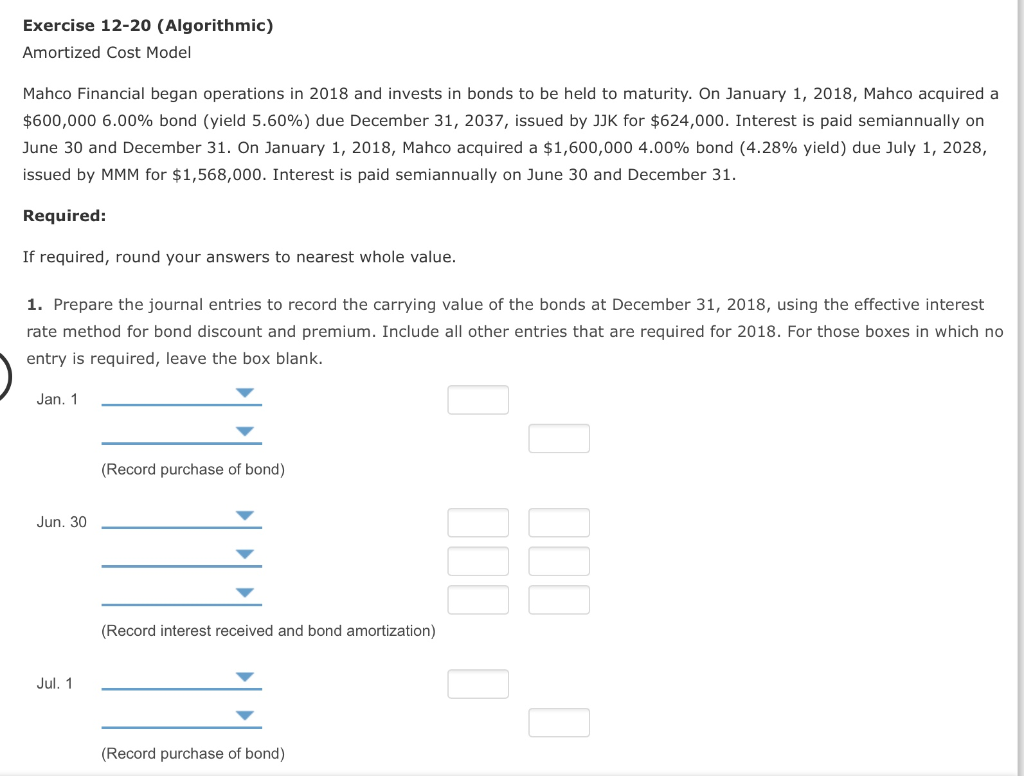

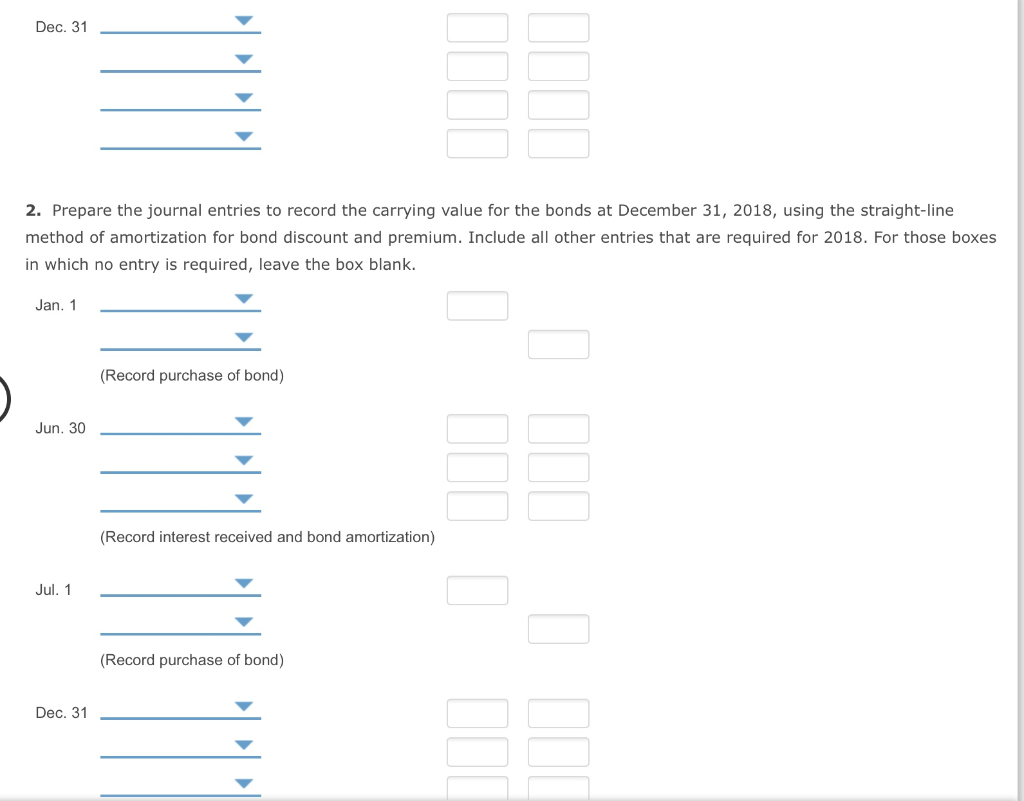

Exercise 12-20 (Algorithmic) Amortized Cost Model Mahco Financial began operations in 2018 and invests in bonds to be held to maturity. On January 1, 2018, Mahco acquired a $600,000 6.00% bond (yield 5.60%) due December 31, 2037, issued by JJK for $624,000. Interest is paid semiannually on June 30 and December 31. On January 1, 2018, Mahco acquired a $1,600,000 4.00% bond (4.28% yield) due July 1, 2028, issued by MMM for $1,568,000. Interest is paid semiannually on June 30 and December 31. Required: If required, round your answers to nearest whole value. 1. Prepare the journal entries to record the carrying value of the bonds at December 31, 2018, using the effective interest rate method for bond discount and premium. Include all other entries that are required for 2018. For those boxes in which no entry is required, leave the box blank. Jan. 1 (Record purchase of bond) Jun. 30 (Record interest received and bond amortization) Jul. 1 (Record purchase of bond) Dec. 31 2. Prepare the journal entries to record the carrying value for the bonds at December 31, 2018, using the straight-line method of amortization for bond discount and premium. Include all other entries that are required for 2018. For those boxes in which no entry is required, leave the box blank. Jan. 1 (Record purchase of bond) Jun. 30 (Record interest received and bond amortization) Jul. 1 (Record purchase of bond) Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts