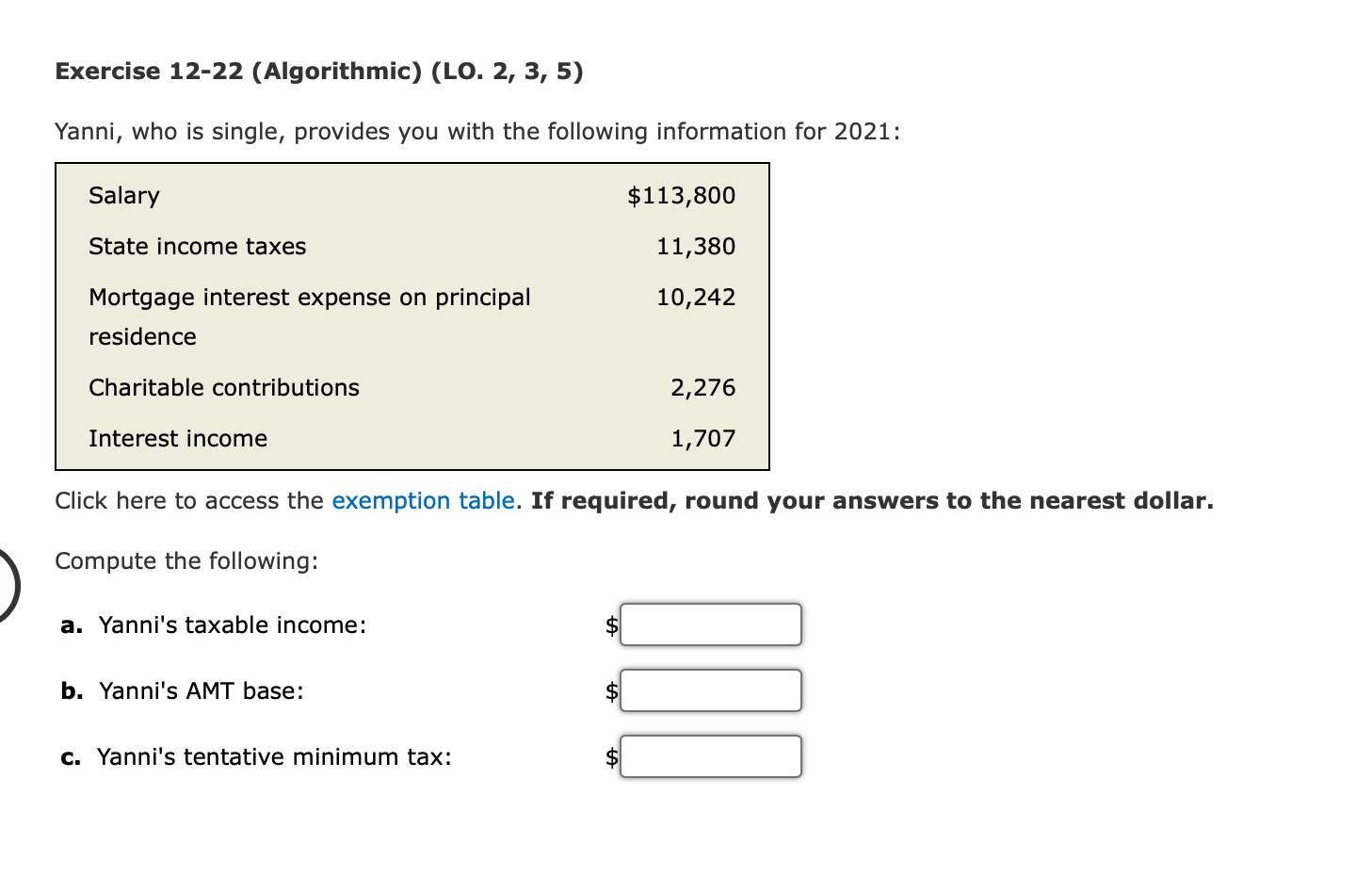

Question: Exercise 12-22 (Algorithmic) (LO. 2, 3, 5) Yanni, who is single, provides you with the following information for 2021: Salary $113,800 State income taxes 11,380

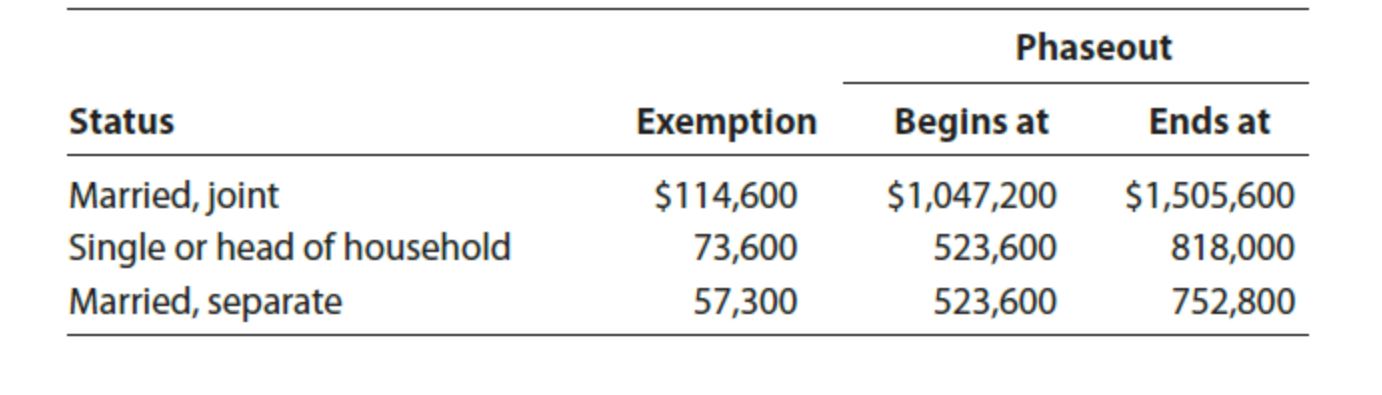

Exercise 12-22 (Algorithmic) (LO. 2, 3, 5) Yanni, who is single, provides you with the following information for 2021: Salary $113,800 State income taxes 11,380 Mortgage interest expense on principal 10,242 residence Charitable contributions 2,276 Interest income 1,707 Click here to access the exemption table. If required, round your answers to the nearest dollar. Compute the following: a. Yanni's taxable income: $:] b. Yanni's AMT base: 33:] c. Yanni's tentative minimum tax: $:] Phaseout Status Exemption Begins at Ends at Married, joint $114,600 $1,047,200 $1,505,600 Single or head of household 73,600 523,600 818,000 Married, separate 57,300 523,600 752,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts