Question: Exercise 12-25 (Algorithmic) Fair Value and Equity Methods Nadal Corporation purchased 11,100 common shares of Beck Inc., on January 1, 2018, for $105,000. During 2018,

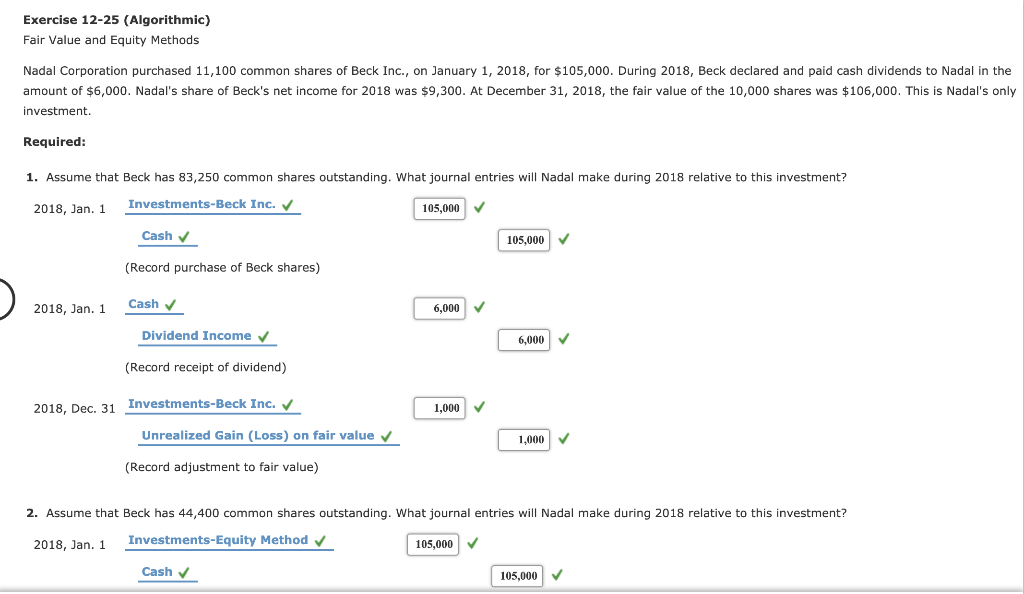

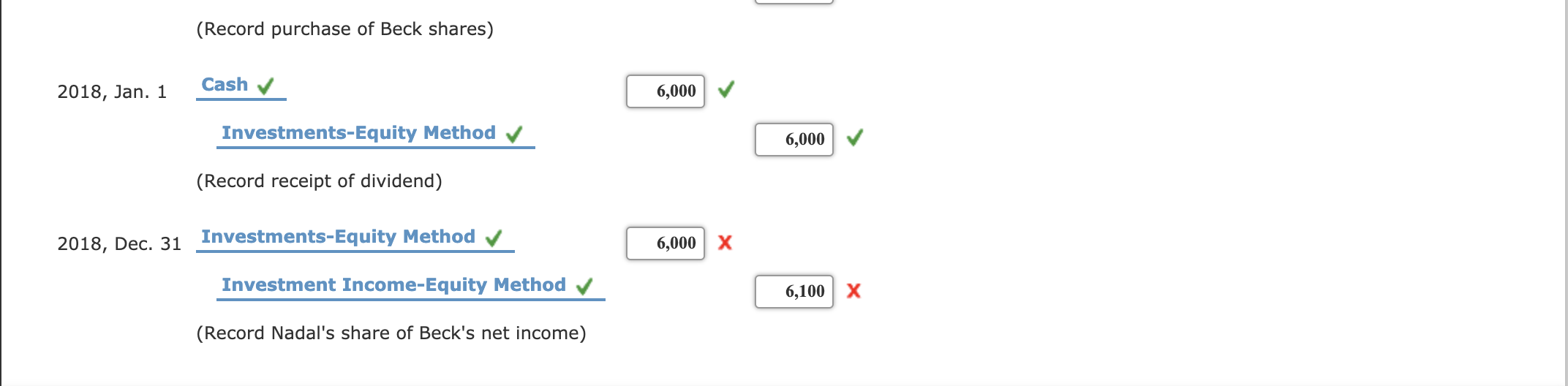

Exercise 12-25 (Algorithmic) Fair Value and Equity Methods Nadal Corporation purchased 11,100 common shares of Beck Inc., on January 1, 2018, for $105,000. During 2018, Beck declared and paid cash dividends to Nadal in the amount of $6,000. Nadal's share of Beck's net income for 2018 was $9,300. At December 31, 2018, the fair value of the 10,000 shares was $106,000. This is Nadal's only investment. Required: 1. Assume that Beck has 83,250 common shares outstanding. What journal entries will Nadal make during 2018 relative to this investment? 2018, Jan. 1 Investments-Beck Inc. 105,000 Cash 105,000 (Record purchase of Beck shares) 2018, Jan. 1 Cash 6,000 Dividend Income 6,000 (Record receipt of dividend) 2018, Dec. 31 Investments-Beck Inc. 1,000 Unrealized Gain (Loss) on fair value 1,000 (Record adjustment to fair value) 2. Assume that Beck has 44,400 common shares outstanding. What journal entries will Nadal make during 2018 relative to this investment? 2018, Jan. 1 Investments-Equity Method 105,000 Cash 105,000 (Record purchase of Beck shares) Cash 2018, Jan. 1 6,000 Investments-Equity Method 6,000 (Record receipt of dividend) 2018, Dec. 31 Investments-Equity Method 6,000 Investment Income-Equity Method 6,100 X (Record Nadal's share of Beck's net income)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts