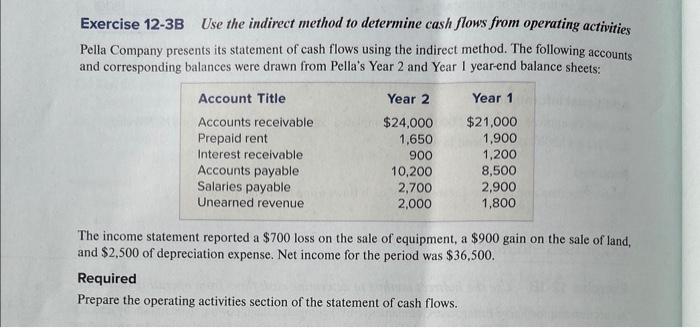

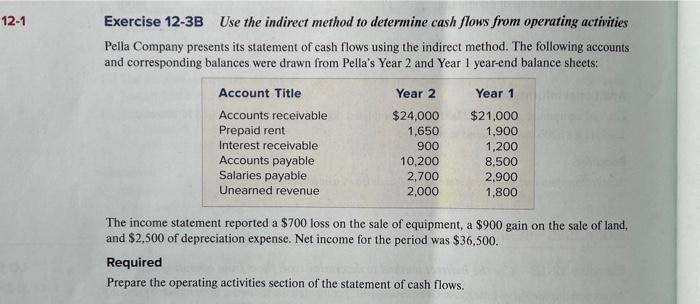

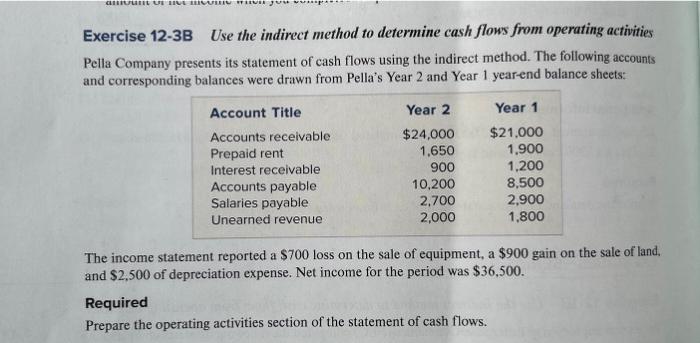

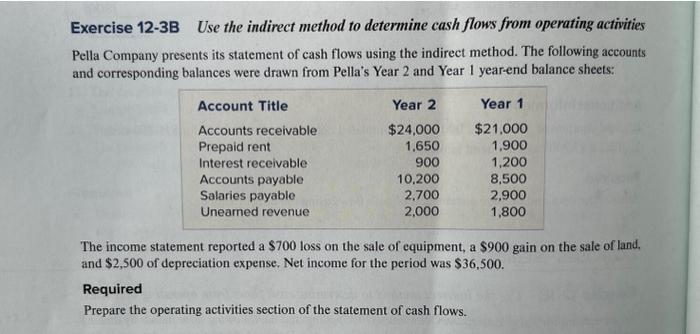

Question: EXERCISE 12-3B Exercise 12-3B Use the indirect method to determine cash flows from operating activities Pella Company presents its statement of cash flows using the

Exercise 12-3B Use the indirect method to determine cash flows from operating activities Pella Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Pella's Year 2 and Year 1 year-end balance sheets: The income statement reported a $700 loss on the sale of equipment, a $900 gain on the sale of land, and $2,500 of depreciation expense. Net income for the period was $36,500. Required Prepare the operating activities section of the statement of cash flows. Exercise 12-3B Use the indirect method to determine cash flows from operating activities Pella Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Pella's Year 2 and Year 1 year-end balance sheets: The income statement reported a $700 loss on the sale of equipment, a $900 gain on the sale of land, and $2,500 of depreciation expense. Net income for the period was $36,500. Required Prepare the operating activities section of the statement of cash flows. Exercise 12-3B Use the indirect method to determine cash flows from operating activities Pella Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Pella's Year 2 and Year 1 yearend balance sheets: The income statement reported a $700 loss on the sale of equipment, a $900 gain on the sale of land, and $2,500 of depreciation expense. Net income for the period was $36,500. Required Prepare the operating activities section of the statement of cash flows. Exercise 12-3B Use the indirect method to determine cash flows from operating activities Pella Company presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from Pella's Year 2 and Year 1 yearend balance sheets: The income statement reported a $700 loss on the sale of equipment, a $900 gain on the sale of land, and $2,500 of depreciation expense. Net income for the period was $36,500. Required Prepare the operating activities section of the statement of cash flows. Frercise 3B: \begin{tabular}{|l|l|l|l|} \hline Cash Flows from Operating Activities & \\ \hline Net Income & \\ \hline Add: & & \\ \hline & & & \\ \hline & & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Less: & & \\ \hline & & \\ \hline & & \\ \hline & Net Cash Inflow from Operating Activities & \\ \hline \end{tabular} Exercise 3B: \begin{tabular}{|l|l|l|} \hline Cash Flows from Operating Activities & \\ \hline Net Income & \\ \hline Add: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Less: & & \\ \hline & & \\ \hline & & \\ \hline & Net Cash Inflow from Operating Activities & \\ \hline \end{tabular} Trereise 3B: \begin{tabular}{|l|l|l|} \hline \multicolumn{4}{|l|}{ Cash Flows from Operating Activities } \\ \hline Net Income & \\ \hline Add: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Less: & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Net Cash Inflow from Operating Activities & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts