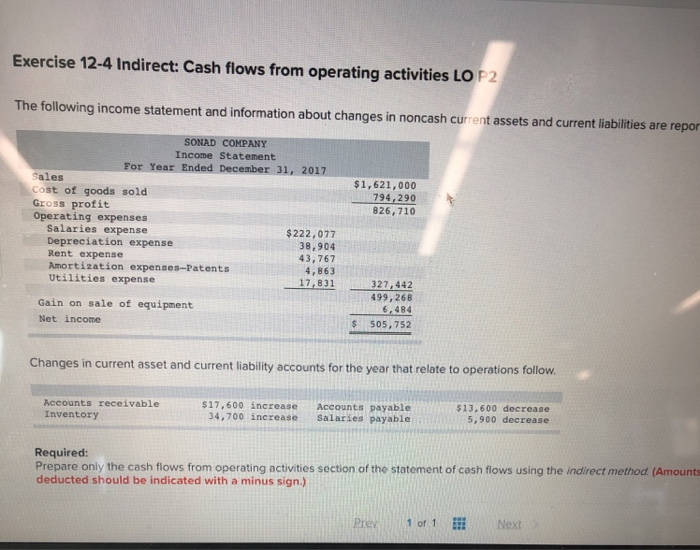

Question: Exercise 12-4 Indirect: Cash flows from operating activities LO P2 The following income statement and information about changes in noncash curent assets and current liabilities

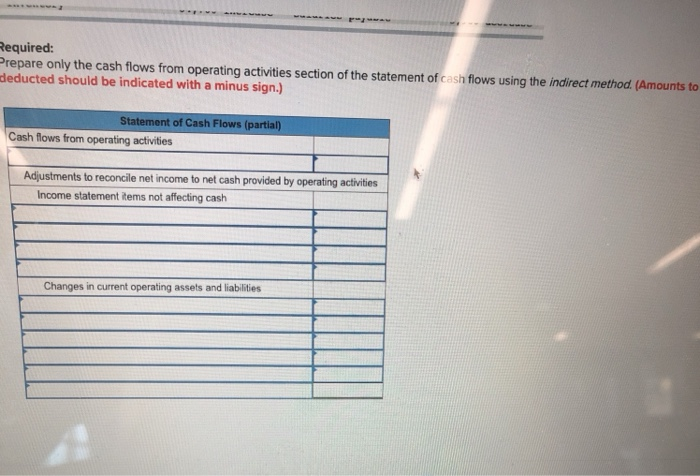

Exercise 12-4 Indirect: Cash flows from operating activities LO P2 The following income statement and information about changes in noncash curent assets and current liabilities are repor SONAD COMPANY Income Statement For Year Ended December 31, 2017 Sales $1,621,000 794,290 826,710 Cost of goods sold Gross profit Operating expenses $222,077 38,904 43,767 4,863 Salaries expense Depreciation expense Rent expense Amortization expenses-Patents Utilities expense 17,831327,442 499,268 6.484 $ 505,752 Gain on sale of equipment Net income Changes in current asset and current liability accounts for the year that relate to operations follow $13,600 decrease 5, 900 decrease $17,600 increase Accounts payable 34,700 increaseSalaries payable Accounts receivable Inventory Required: Prepare only the cash flows from operating activities section of the statement of cash flows using the indirect method (Amounts deducted should be indicated with a minus sign.) Prev 1of 1 Next Required: Prepare only the cash flows from operating activities section of the statement of cash flows using the indirect method. (Amounts to deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Cash flows from operating activities Adjustments to reconcile net income to net cash provided by operating activities ncome statement tems not affecting cash Changes in current operating assets and liabilities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts