Question: Exercise 12-44 (Static) Identifying Relevant Cash Flows; Asset Replacement Decision [123,128] Assume that it is January 1,2022 and that the Mendoza Company is considering the

![Exercise 12-44 (Static) Identifying Relevant Cash Flows; Asset Replacement Decision [123,128]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66facbda4cbd9_21766facbd9e1741.jpg)

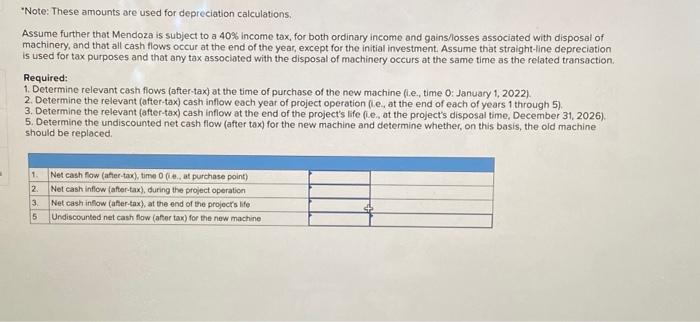

Exercise 12-44 (Static) Identifying Relevant Cash Flows; Asset Replacement Decision [123,128] Assume that it is January 1,2022 and that the Mendoza Company is considering the replacement of a machine that has been used for the past 3 years in a special project for the company. This project is expected to continue for an additional 5 years (i,e., until the end of 2026). Mendoza will either keep the existing machine for another 5 years ( 8 yoars tota) or replace the existing machine now with a new model that has a 5 -year estimated life. Pertinent focts regarding this decision are as folliows: "Note: These amounts are used for depreciation calculations Assume further that Mendoza is subject to a 40% income tax, for both ordinary income ond gains/losses associated with disposal of machinery, and that all cash flows occur at the end of the year, except for the intial investment. Assume that straight-line depreciation is used for tax purposes and that any tax associated with the disposal of machinery occurs at the same time as the related transaction. Required: 1. Determine relevant cash flows (aftertax) to the time of purchase of the new machine (ie, time 0 : January 1,2022). 2. Determine the relevant (afier-tax) cash inflow each year of project operation (le, at the end of each of years 1 through 5 ) 3. Determine the relevant (after tax) cash infow at the end of the projects Me (ie. at the projocts disposal time, December 31, 2026). 5. Determine the undiscounted net cash fiow (offer tax) for the new machine and determine whether, on ths basis, the old mochine should be renlaced. "Note: These amounts are used for depreciation calculations. Assume further that Mendoza is subject to a 40% income tax, for both ordinary income and gains/osses associated with disposal of machinery, and that all cash flows occur at the end of the year, except for the initial investment. Assume that straight-line depreciation is used for tax purposes and that any tax associated with the disposal of machinery occurs at the same time as the related transaction. Required: 1. Determine relevant cash flows (after-tax) at the time of purchase of the new machine (i.e., time 0 : January 1, 2022). 2. Determine the relevant (after-tax) cash inflow each year of project operation (i.e, at the end of each of years 1 through 5) 3. Determine the relevant (after-tax) cash inflow at the end of the project's life (ie., at the project's disposai time, December 31,2026 ). 5. Determine the undiscounted net cash flow (after tox) for the new machine and determine whether, on this basis, the old machine should be replaced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts