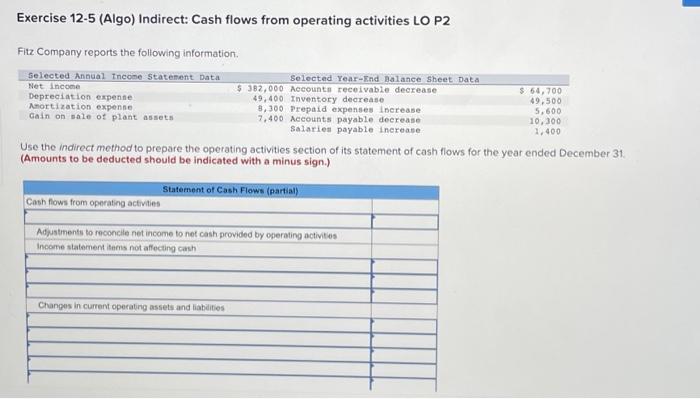

Question: Exercise 12-5 (Algo) Indirect: Cash flows from operating activities LO P2 Fitz Company reports the following information. Selected Annual Income Statement Data Net income Depreciation

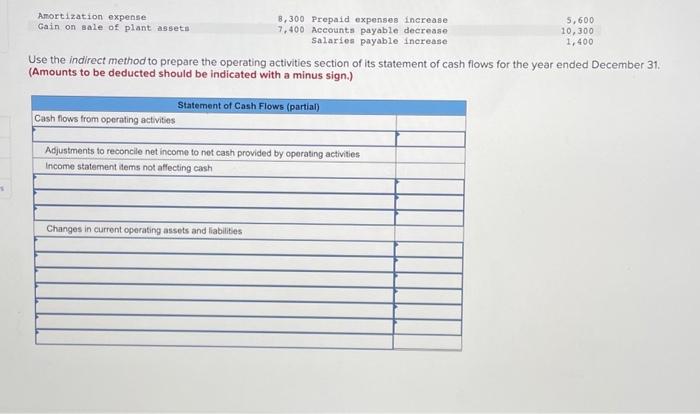

Exercise 12-5 (Algo) Indirect: Cash flows from operating activities LO P2 Fitz Company reports the following information. Selected Annual Income Statement Data Net income Depreciation expense Amortization expense Gain on sale of plant assets Cash flows from operating activities Selected Year-End Balance Sheet Data $ 382,000 Accounts receivable decrease 49,400 Inventory decrease 8,300 Prepaid expenses increase 7,400 Accounts payable decrease Salaries payable increase Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. (Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows (partial) Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Changes in current operating assets and liabilities $ 64,700 49,500 5,600 10,300 1,400

Exercise 12-5 (Algo) Indirect: Cash flows from operating activities LO P2 Fitz Company reports the following information. Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31 (Amounts to be deducted should be indicated with a minus sign.) Use the indirect method to prepare the operating activities section of its statement of cash flows for the year ended December 31. (Amounts to be deducted should be indicated with a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock