Question: Exercise 12-51 Recording and Preparing Schedule Using Sum-of-the- Year-Digits Method Depreciation, Partial Year LOZ An asset was purchased October 1, 2020, costing $20.000, with a

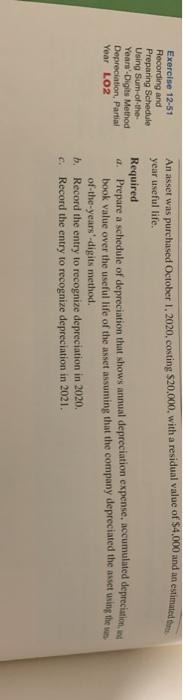

Exercise 12-51 Recording and Preparing Schedule Using Sum-of-the- Year-Digits Method Depreciation, Partial Year LOZ An asset was purchased October 1, 2020, costing $20.000, with a residual value of $4,000 and an estimated to year useful life. Required a. Prepare a schedule of depreciation that shows annual depreciation expense, accumulated depreciation, in book value over the useful life of the asset assuming that the company depreciated the asset using the un of-the-years-digits method. b. Record the entry to recognize depreciation in 2020. c. Record the entry to recognize depreciation in 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts