Question: Exercise 12-6 Simple Rate of Return Method [LO12-6) The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $50,000. The

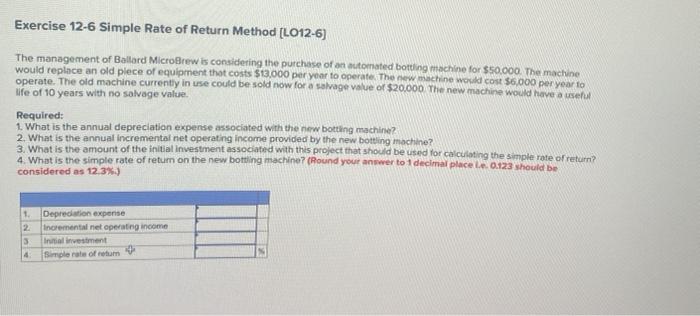

Exercise 12-6 Simple Rate of Return Method [LO12-6) The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $50,000. The machine would replace an old piece of equipment that costs $13,000 per year to operate. The new machine would cost $6,000 per year to operate. The old machine currently in use could be sold now for a salvage value of $20.000 The new machine would have a ser life of 10 years with no salvage value Required: 1. What is the annual depreciation expense associated with the new botting machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of retum on the new bottling machine? (Round your answer to 1 decimal place 0.123 should be considered as 12.3%) 1 2 3 Deprecation expense Incremental net operating income Initial investment Simple rate of retum 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts