Question: Exercise 12-6 Your answer is partially correct. Try again. On February 1, Rinehart Company purchased 380 shares (2% ownership) of Givens Company common stock for

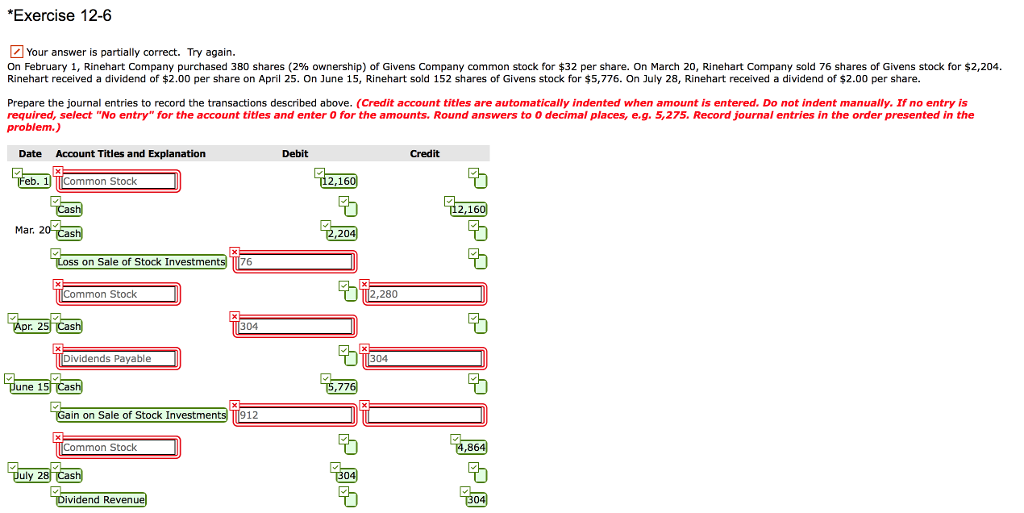

Exercise 12-6 Your answer is partially correct. Try again. On February 1, Rinehart Company purchased 380 shares (2% ownership) of Givens Company common stock for $32 per share, on March 20, Rinehart Company sold 76 shares of Givens stock for $2,204. Rinehart received a dividend of $2.00 per share on April 25. On June 15, Rinehart sold 152 shares of Givens stock for $5,776. On July 28, Rinehart received a dividend of $2.00 per share. Prepare the journal entries to record the transactions described above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round answers to 0 decimal places, e.g. 5,275. Record journal entries in the order presented in the problem.,) Date Account Titles and Explanation Debit Credit Common Stock 2,16 Mar. 2 20 ss on Sale of Stock Investments 76 Common Stock 2,280 304 Dividends Payable 304 une 1 in on Sale of Stock Investments 912 Common Stock 864 uly 28 vidend Reven

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts