Question: Exercise 12.7 Doubtful debts ageing method over 2 years While accounting for accounts receivable for Easy DVD Ltd, the following information became available to the

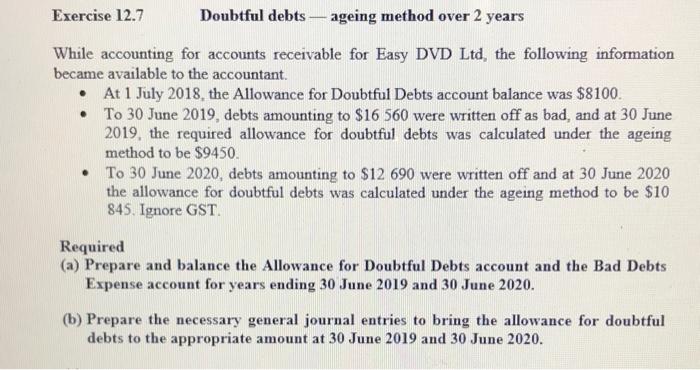

Exercise 12.7 Doubtful debts ageing method over 2 years While accounting for accounts receivable for Easy DVD Ltd, the following information became available to the accountant. At 1 July 2018, the Allowance for Doubtful Debts account balance was $8100. To 30 June 2019, debts amounting to $16 560 were written off as bad, and at 30 June 2019, the required allowance for doubtful debts was calculated under the ageing method to be $9450. To 30 June 2020, debts amounting to $12 690 were written off and at 30 June 2020 the allowance for doubtful debts was calculated under the ageing method to be $10 845. Ignore GST Required (a) Prepare and balance the Allowance for Doubtful Debts account and the Bad Debts Expense account for years ending 30 June 2019 and 30 June 2020. (b) Prepare the necessary general journal entries to bring the allowance for doubtful debts to the appropriate amount at 30 June 2019 and 30 June 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts