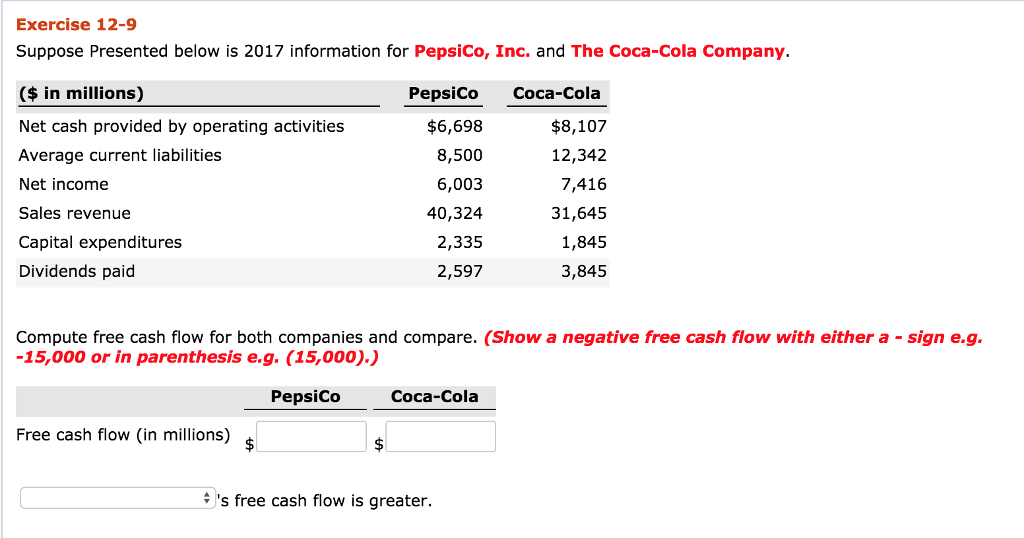

Question: Exercise 12-9 Suppose Presented below is 2017 information for PepsiCo, Inc. and The Coca-Cola Company. ($ in millions) Net cash provided by operating activities Average

Exercise 12-9 Suppose Presented below is 2017 information for PepsiCo, Inc. and The Coca-Cola Company. ($ in millions) Net cash provided by operating activities Average current liabilities Net income Sales revenue Capital expenditures Dividends paid PepsiCo Coca-Cola $8,107 12,342 7,416 31,645 1,845 3,845 $6,698 8,500 6,003 40,324 2,335 2,597 Compute free cash flow for both companies and compare. (Show a negative free cash flow with either a -sign e.g. -15,000 or in parenthesis e.g. (15,000).) PepsiCo Coca-Cola Free cash flow (in millions) 's free cash flow is greater

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts