Question: EXERCISE 1.3 Set up a spreadsheet to analyze the following issues arising in the Bio-Imaging development strategies example (a) How does the optimal decision strategy

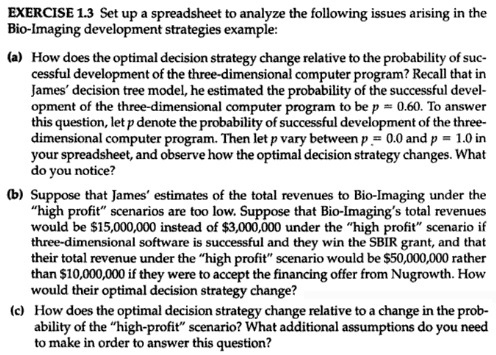

EXERCISE 1.3 Set up a spreadsheet to analyze the following issues arising in the Bio-Imaging development strategies example (a) How does the optimal decision strategy change relative to the probability of suc- cessful development of the three-dimensional computer program? Recall that in James' decision tree model, he estimated the probability of the successful devel- opment of the three-dimensional computer program to be p0.60. To answer this question, let p denote the probability of successful development of the three- dimensional computer program. Then let p vary between p 0.0 and p 1.0 in your spreadsheet, and observe how the optimal decision strategy changes. What do you notice? (b) Suppose that James' estimates of the total revenues to Bio-Imaging under the high profit" scenarios are too low. Suppose that Bio-Imaging's total revenues would be $15,000,000 instead of $3,000,000 under the "high profit" scenario if three-dimensional software is successful and they win the SBIR grant, and that their total revenue under the "high profit" scenario would be $50,000,000 rather than $10,000,000 if they were to accept the financing offer from Nugrowth. How would their optimal decision strategy change? (c) How does the optimal decision strategy change relative to a change in the prob- ability of the "high-profit" scenario? What additional assumptions do you need to make in order to answer this question? EXERCISE 1.3 Set up a spreadsheet to analyze the following issues arising in the Bio-Imaging development strategies example (a) How does the optimal decision strategy change relative to the probability of suc- cessful development of the three-dimensional computer program? Recall that in James' decision tree model, he estimated the probability of the successful devel- opment of the three-dimensional computer program to be p0.60. To answer this question, let p denote the probability of successful development of the three- dimensional computer program. Then let p vary between p 0.0 and p 1.0 in your spreadsheet, and observe how the optimal decision strategy changes. What do you notice? (b) Suppose that James' estimates of the total revenues to Bio-Imaging under the high profit" scenarios are too low. Suppose that Bio-Imaging's total revenues would be $15,000,000 instead of $3,000,000 under the "high profit" scenario if three-dimensional software is successful and they win the SBIR grant, and that their total revenue under the "high profit" scenario would be $50,000,000 rather than $10,000,000 if they were to accept the financing offer from Nugrowth. How would their optimal decision strategy change? (c) How does the optimal decision strategy change relative to a change in the prob- ability of the "high-profit" scenario? What additional assumptions do you need to make in order to answer this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts