Question: Exercise 13-1 Net Present Value Method L011 The management of Opry Company, a wholesale distributor of suntan products, is considering the purchase of a $20,000

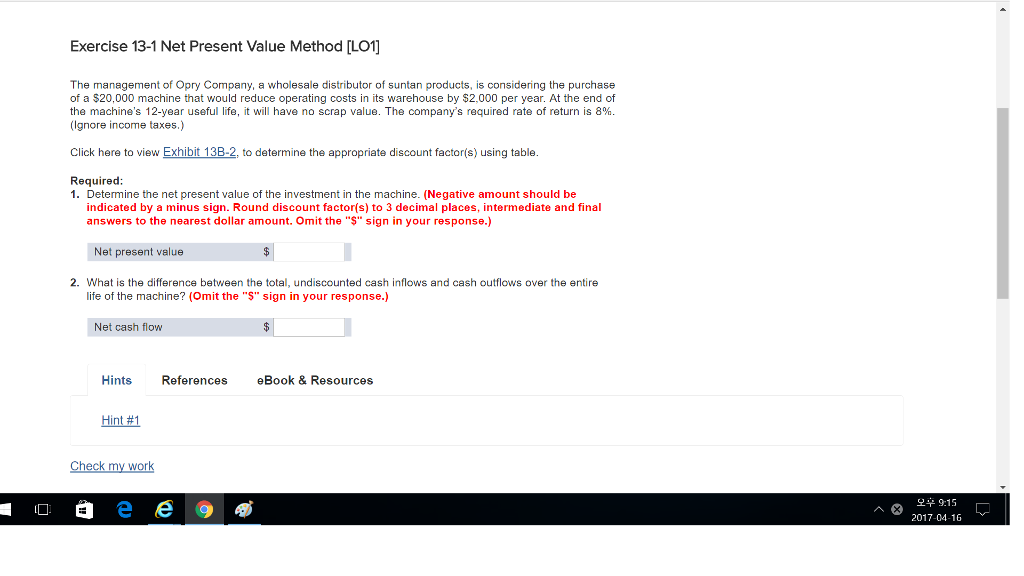

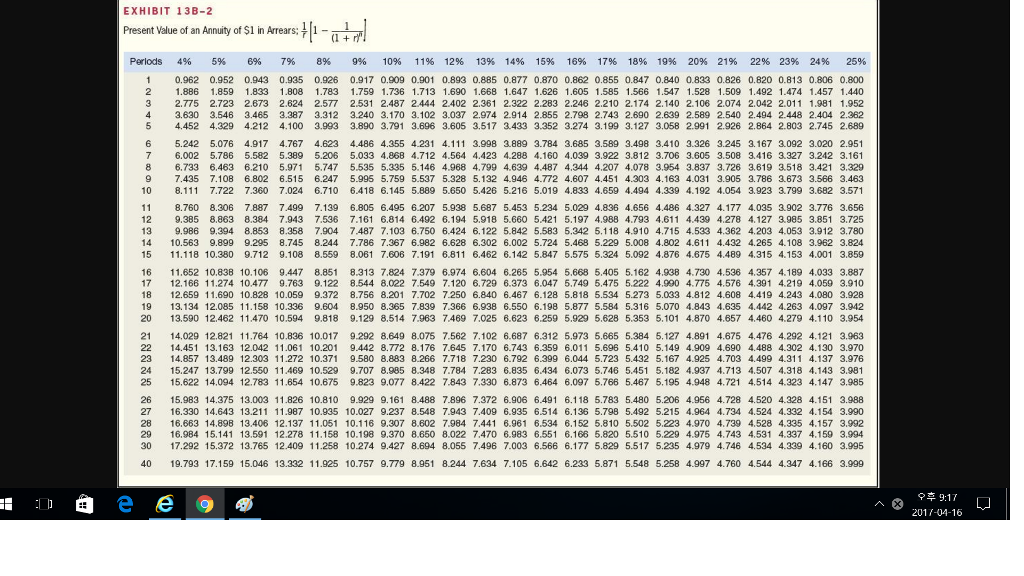

Exercise 13-1 Net Present Value Method L011 The management of Opry Company, a wholesale distributor of suntan products, is considering the purchase of a $20,000 machine that would reduce operating costs in its warehouse by $2,000 per year. At the end of the machine's 12-year useful life, it will have no scrap value. The company's required rate of return is 8%. (Ignore income taxes.) Click here to view Exhibi 3B-2, to determine the appropriate discount factor(s) using table. Required 1. Determine the net present value of the investment in the machine. (Negative amount should be indicated by a minus sign. Round discount factor(s) to 3 decimal places, intermediate and final answers to the nearest dollar amount. Omit the "S" sign in your response.) Net present value 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? (omit the "S" sign in your response.) Net cash flow Hints rences eBook & Resources Hint #1 Check my work 2 9:15 2017-04-16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts