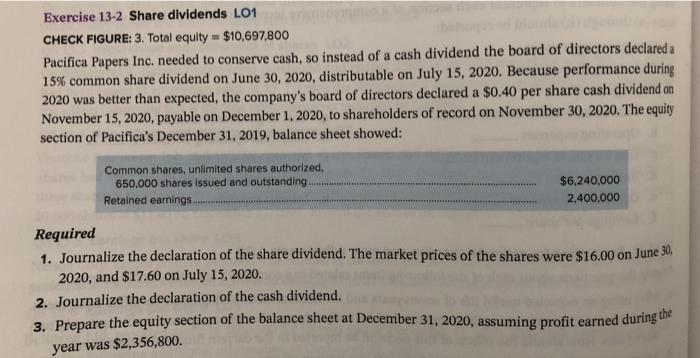

Question: Exercise 13-2 Share dividends LO1 CHECK FIGURE: 3. Total equity - $10,697,800 Pacifica Papers Inc. needed to conserve cash, so instead of a cash dividend

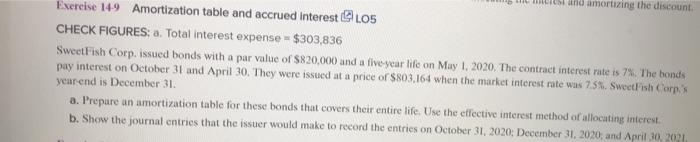

Exercise 13-2 Share dividends LO1 CHECK FIGURE: 3. Total equity - $10,697,800 Pacifica Papers Inc. needed to conserve cash, so instead of a cash dividend the board of directors declared a 15% common share dividend on June 30, 2020, distributable on July 15, 2020. Because performance during 2020 was better than expected, the company's board of directors declared a $0,40 per share cash dividend on November 15, 2020, payable on December 1, 2020, to shareholders of record on November 30, 2020. The equity section of Pacifica's December 31, 2019, balance sheet showed: Common shares, unlimited shares authorized 650,000 shares issued and outstanding Retained earnings $6,240,000 2,400,000 Required 1. Journalize the declaration of the share dividend. The market prices of the shares were $16.00 on June 30, 2020, and $17.60 on July 15, 2020. 2. Journalize the declaration of the cash dividend. 3. Prepare the equity section of the balance sheet at December 31, 2020, assuming profit earned during the year was $2,356,800. amortizing the discount Exercise 14.9 Amortization table and accrued interest 105 CHECK FIGURES: a. Total interest expense - $303,836 SweetFish Corp. issued bonds with a par value of $820,000 and a five year life on May 1, 2020. The contract interest rate is 7%. The bonds pay interest on October 31 and April 30. They were issued at a price of $803,164 when the market interest rate was 7.5%. SweetFish Corps yearend is December 31, a. Prepare an amortization table for these bonds that covers their entire life. Use the effective interest method of allocating interest b. Show the journal entries that the issuer would make to record the entries on October 31, 2020; December 31, 2020, and April 30 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts