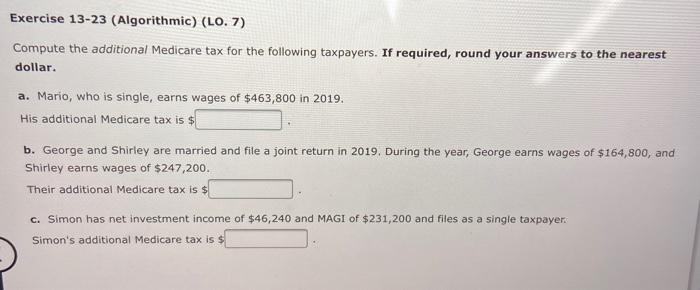

Question: Exercise 13-23 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario,

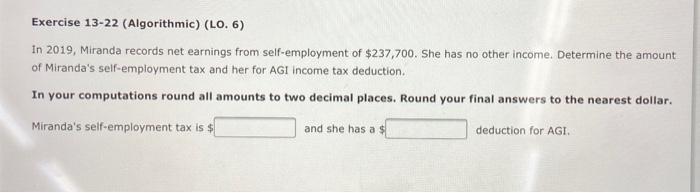

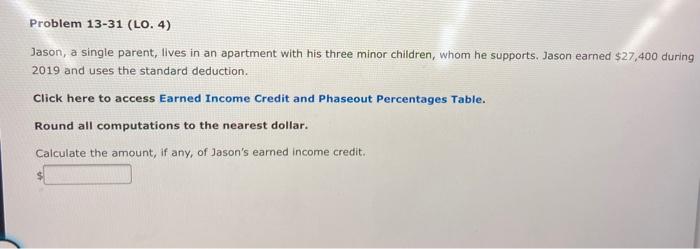

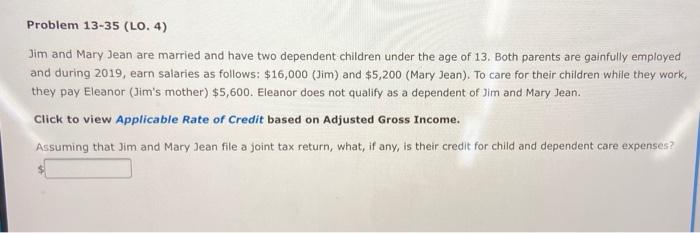

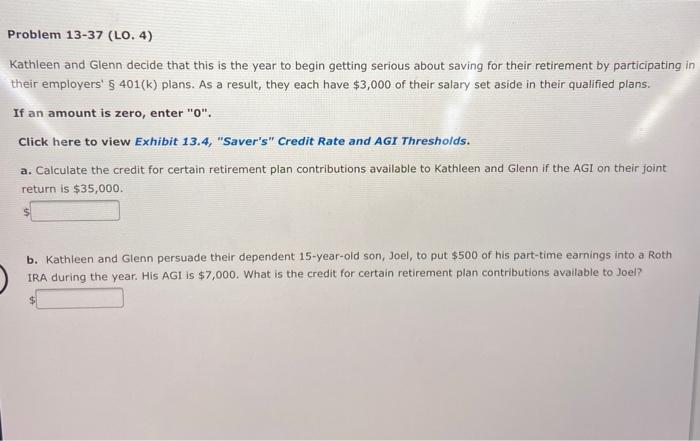

Exercise 13-23 (Algorithmic) (LO. 7) Compute the additional Medicare tax for the following taxpayers. If required, round your answers to the nearest dollar. a. Mario, who is single, earns wages of $463,800 in 2019. His additional Medicare tax is $ b. George and Shirley are married and file a joint return in 2019. During the year, George earns wages of $164,800, and Shirley earns wages of $247,200. Their additional Medicare tax is $ c. Simon has net investment income of $46,240 and MAGI of $231,200 and files as a single taxpayers Simon's additional Medicare tax is $ Exercise 13-22 (Algorithmic) (LO. 6) In 2019, Miranda records net earnings from self-employment of $237,700. She has no other income. Determine the amount of Miranda's self-employment tax and her for AGI Income tax deduction In your computations round all amounts to two decimal places. Round your final answers to the nearest dollar. Miranda's self-employment tax is $ and she has a $ deduction for AGI Problem 13-31 (LO. 4) Jason, a single parent, lives in an apartment with his three minor children, whom he supports. Jason earned $27,400 during 2019 and uses the standard deduction Click here to access Earned Income Credit and Phaseout Percentages Table. Round all computations to the nearest dollar. Calculate the amount, if any, of Jason's earned Income credit. Problem 13-35 (LO. 4) Jim and Mary Jean are married and have two dependent children under the age of 13. Both parents are gainfully employed and during 2019, earn salaries as follows: $16,000 (Jim) and $5,200 (Mary Jean). To care for their children while they work, they pay Eleanor (Jim's mother) $5,600. Eleanor does not qualify as a dependent of Jim and Mary Jean. Click to view Applicable Rate of Credit based on Adjusted Gross Income. Assuming that Jim and Mary Jean file a joint tax return, what, if any, is their credit for child and dependent care expenses? Problem 13-37 (LO.4) Kathleen and Glenn decide that this is the year to begin getting serious about saving for their retirement by participating in their employers' $ 401(k) plans. As a result, they each have $3,000 of their salary set aside in their qualified plans. If an amount is zero, enter "O". Click here to view Exhibit 13.4, "Saver's" Credit Rate and AGI Thresholds. a. Calculate the credit for certain retirement plan contributions available to Kathleen and Glenn if the AGI on their joint return is $35,000. b. Kathleen and Glenn persuade their dependent 15-year-old son, Joel, to put $500 of his part-time earnings into a Roth IRA during the year. His AGI is $7,000. What is the credit for certain retirement plan contributions available to Joel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts