Question: Exercise 13-25 (Algorithmic) (LO. 1) Sally owns real property for which the annual property taxes are $18,180. She sells the property to Kate on

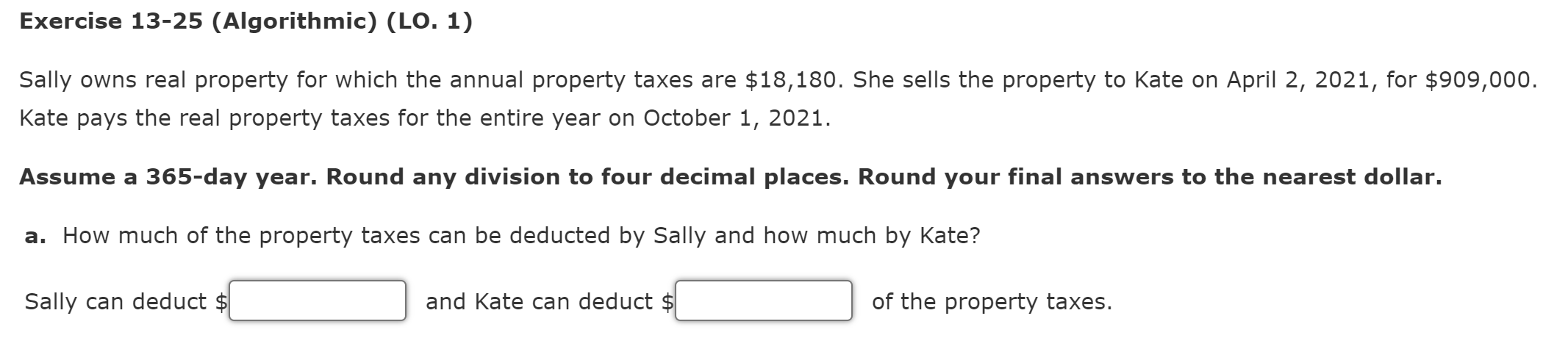

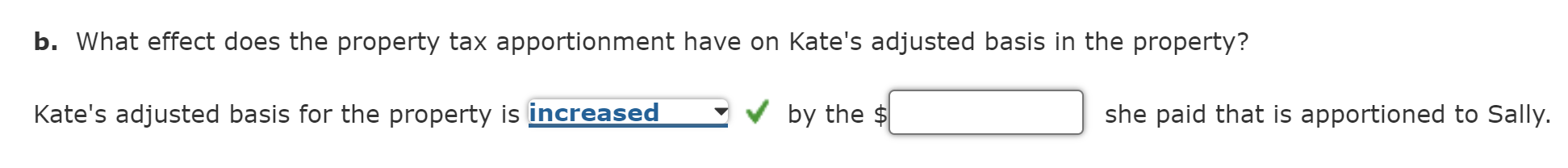

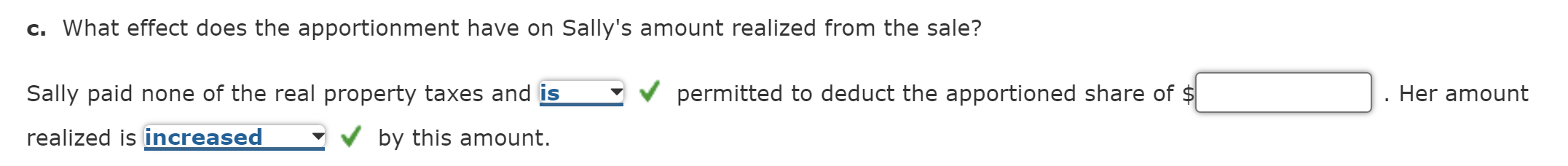

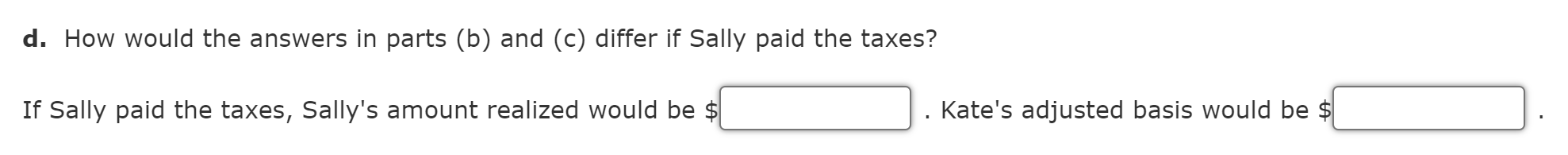

Exercise 13-25 (Algorithmic) (LO. 1) Sally owns real property for which the annual property taxes are $18,180. She sells the property to Kate on April 2, 2021, for $909,000. Kate pays the real property taxes for the entire year on October 1, 2021. Assume a 365-day year. Round any division to four decimal places. Round your final answers to the nearest dollar. a. How much of the property taxes can be deducted by Sally and how much by Kate? Sally can deduct $ and Kate can deduct $ of the property taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock