Question: Exercise 13-27 (Algorithmic) (LO. 5) Roscoe contributes to a business entity a personal use asset with an adjusted basis of $25,200 and a fair market

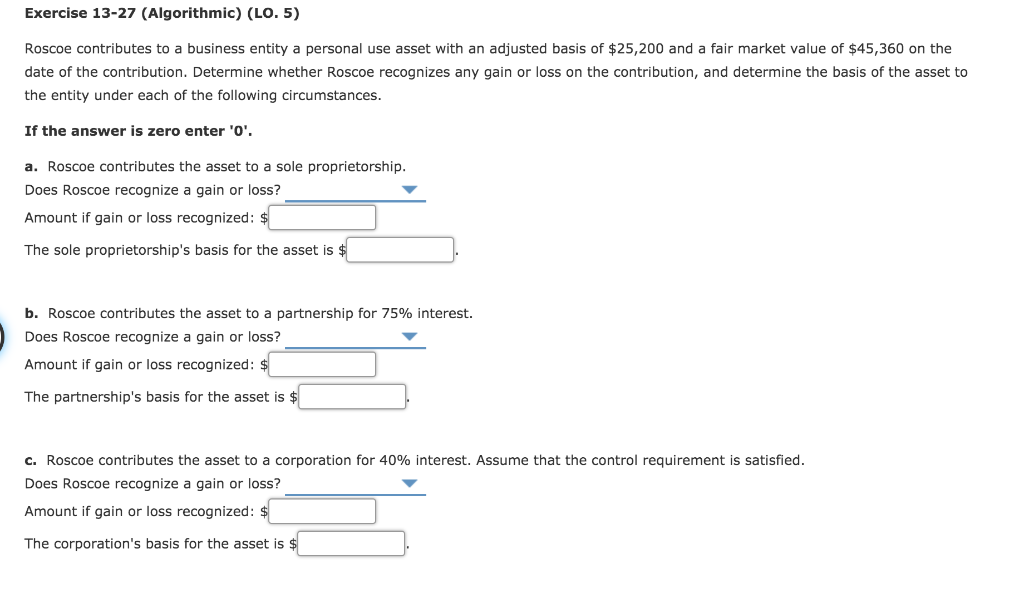

Exercise 13-27 (Algorithmic) (LO. 5) Roscoe contributes to a business entity a personal use asset with an adjusted basis of $25,200 and a fair market value of $45,360 on the date of the contribution. Determine whether Roscoe recognizes any gain or loss on the contribution, and determine the basis of the asset to the entity under each of the following circumstances. If the answer is zero enter 'O'. a. Roscoe contributes the asset to a sole proprietorship. Does Roscoe recognize a gain or loss? Amount if gain or loss recognized: $ The sole proprietorship's basis for the asset is $ b. Roscoe contributes the asset to a partnership for 75% interest. Does Roscoe recognize a gain or loss? Amount if gain or loss recognized : $ The partnership's basis for the asset is $ C. Roscoe contributes the asset to a corporation for 40% interest. Assume that the control requirement is satisfied. Does Roscoe recognize a gain or loss? Amount if gain or loss recognized: $ The corporation's basis for the asset is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts