Question: Exercise 13-37 (Algorithmic) (LO. 7) On June 5, 2020, Brown, Inc., a calendar year taxpayer, receives cash of $824,000 from the county upon condemnation of

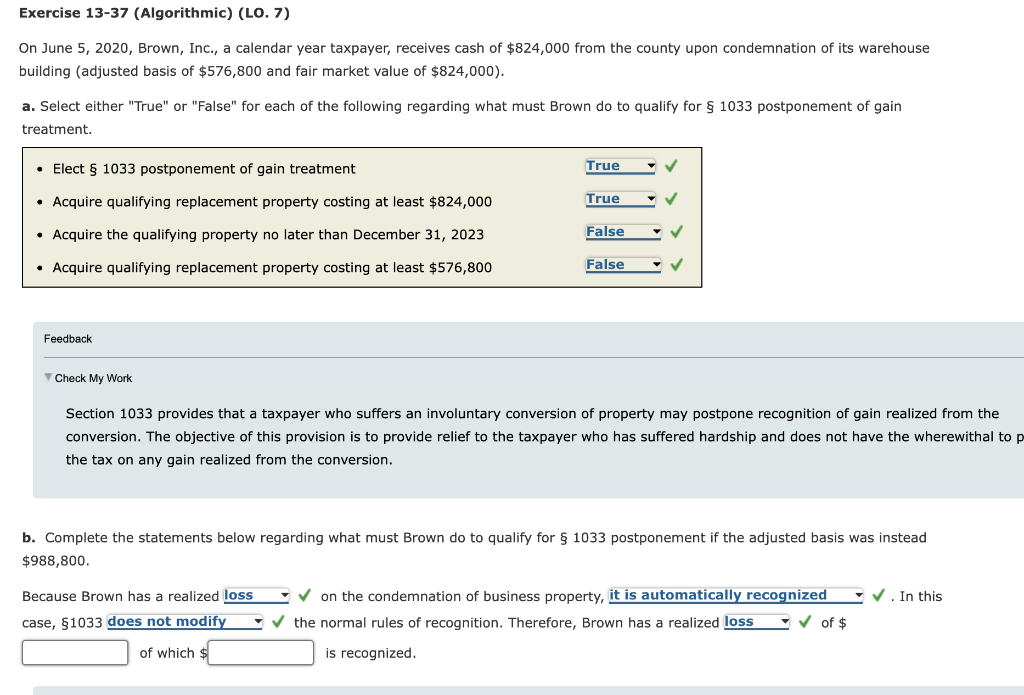

Exercise 13-37 (Algorithmic) (LO. 7) On June 5, 2020, Brown, Inc., a calendar year taxpayer, receives cash of $824,000 from the county upon condemnation of its warehouse building (adjusted basis of $576,800 and fair market value of $824,000). a. Select either "True" or "False" for each of the following regarding what must Brown do to qualify for $ 1033 postponement of gain treatment. Elect 1033 postponement of gain treatment True Acquire qualifying replacement property costing at least $824,000 True Acquire the qualifying property no later than December 31, 2023 False Acquire qualifying replacement property costing at least $576,800 False Feedback Check My Work Section 1033 provides that a taxpayer who suffers an involuntary conversion of property may postpone recognition of gain realized from the conversion. The objective of this provision is to provide relief to the taxpayer who has suffered hardship and does not have the wherewithal to p the tax on any gain realized from the conversion. b. Complete the statements below regarding what must Brown do to qualify for $ 1033 postponement if the adjusted basis was instead $988,800. In this Because Brown has a realized loss case, $1033 does not modify on the condemnation of business property, it is automatically recognized the normal rules of recognition. Therefore, Brown has a realized loss of $ of which $ is recognized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts