Question: Exercise 13-6B Identifying transaction type, its effect on the accounting equation, and whether the effect is recorded with a debit or credit Required Identify

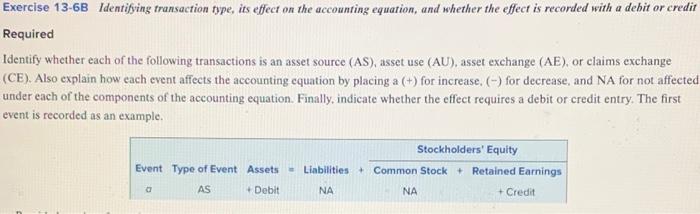

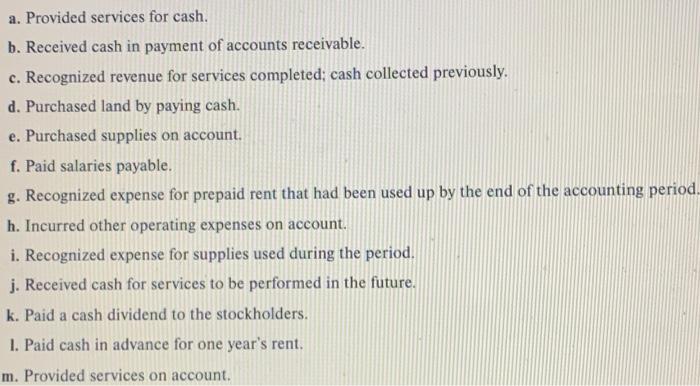

Exercise 13-6B Identifying transaction type, its effect on the accounting equation, and whether the effect is recorded with a debit or credit Required Identify whether each of the following transactions is an asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also explain how each event affects the accounting equation by placing a (+) for increase. (-) for decrease, and NA for not affected under each of the components of the accounting equation. Finally, indicate whether the effect requires a debit or credit entry. The first event is recorded as an example. Stockholders' Equity Event Type of Event Assets Liabilities Common Stock Retained Earnings AS +Debit NA NA + Credit a. Provided services for cash. b. Received cash in payment of accounts receivable. c. Recognized revenue for services completed; cash collected previously. d. Purchased land by paying cash. e. Purchased supplies on account. f. Paid salaries payable. g. Recognized expense for prepaid rent that had been used up by the end of the accounting period... h. Incurred other operating expenses on account. i. Recognized expense for supplies used during the period. j. Received cash for services to be performed in the future. k. Paid a cash dividend to the stockholders. 1. Paid cash in advance for one year's rent. m. Provided services on account.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts