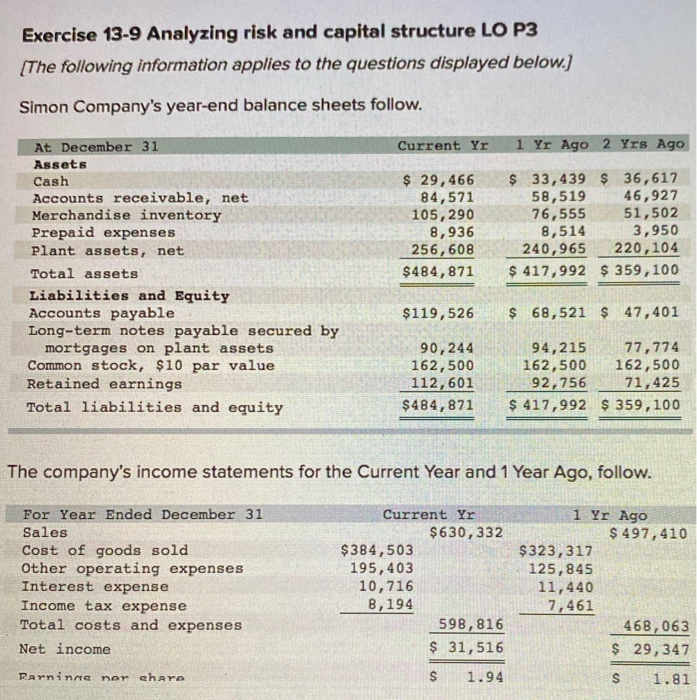

Question: Exercise 13-9 Analyzing risk and capital structure LO P3 (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current

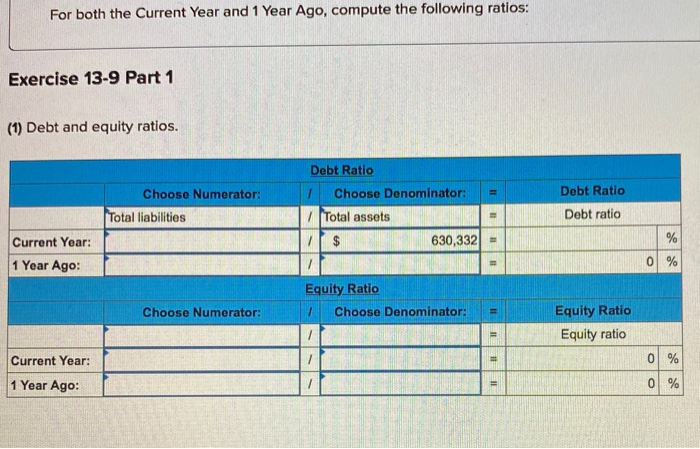

Exercise 13-9 Analyzing risk and capital structure LO P3 (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 29,466 84,571 105,290 8,936 256,608 $484,871 $ 33,439 $ 36,617 58,519 46,927 76,555 51,502 8,514 3,950 240,965 220,104 $ 417,992 $ 359,100 $119,526 $ 68,521 $ 47,401 90,244 162,500 112,601 $484,871 94,215 77,774 162,500 162,500 92,756 71,425 $ 417,992 $ 359,100 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $630, 332 $384,503 195,403 10,716 8,194 598,816 $ 31,516 1 Yr Ago $ 497,410 $323,317 125,845 11,440 7,461 468,063 $ 29,347 Rarninne nor chare S 1.94 $ 1.81 For both the Current Year and 1 Year Ago, compute the following ratios: Exercise 13-9 Part 1 (1) Debt and equity ratios. Debt Ratio Choose Numerator: = Choose Denominator: Total assets $ 630,332) = Debt Ratio Debt ratio Total liabilities % Current Year: 1 Year Ago: 0 % 1 Equity Ratio Choose Denominator: Choose Numerator: = Equity Ratio Equity ratio IF Current Year: 11 0 % 1 Year Ago: = 0 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts