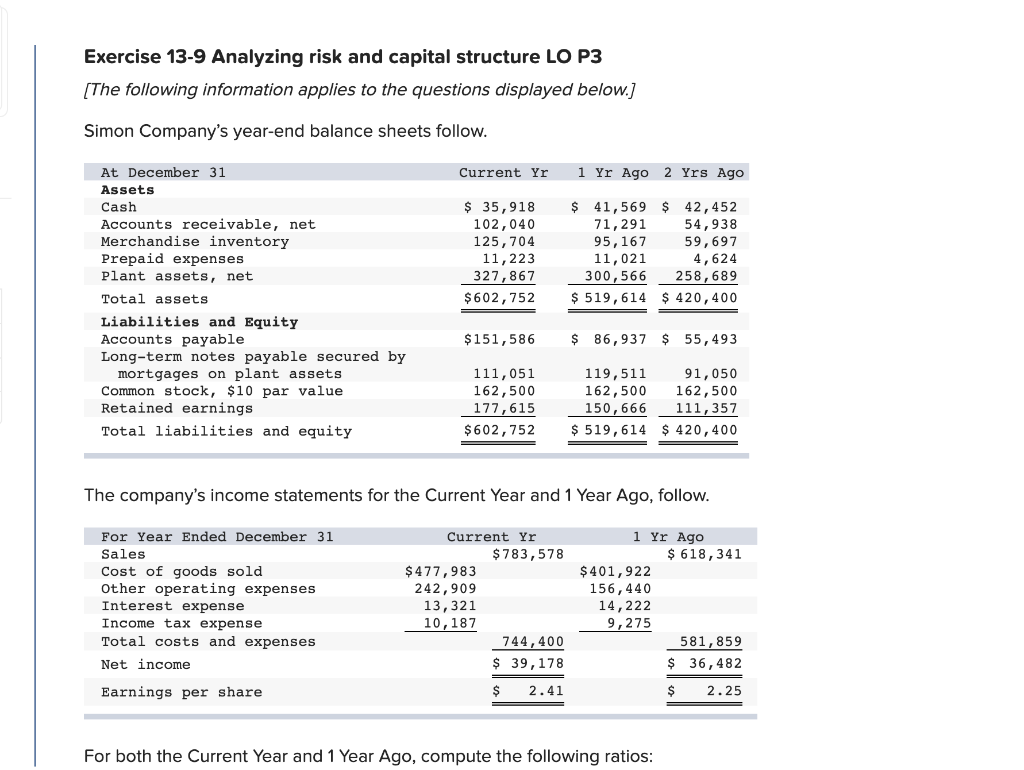

Question: Exercise 13-9 Analyzing risk and capital structure LO P3 [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current

![information applies to the questions displayed below.] Simon Company's year-end balance sheets](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f80e8a98cad_68266f80e8a24afe.jpg)

Exercise 13-9 Analyzing risk and capital structure LO P3 [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 35,918 102,040 125,704 11,223 327,867 $ 602,752 $ 41,569 $ 42, 452 71,291 54,938 95, 167 59,697 11,021 4,624 300,566 258,689 $ 519,614 $ 420, 400 $151,586 $ 86,937 $ 55,493 111,051 162,500 177,615 $602,752 119,511 91,050 162,500 162,500 150,666 111,357 $ 519,614 $ 420, 400 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $ 783,578 $ 477,983 242,909 13,321 10, 187 744,400 $ 39,178 1 Yr Ago $ 618, 341 $401,922 156, 440 14, 222 9, 275 581,859 $ 36, 482 Earnings per share $ 2.41 $ 2.25 For both the Current Year and 1 Year Ago, compute the following ratios: Exercise 13-9 Part 1 (1) Debt and equity ratios. Debt Ratio Choose Numerator: / Choose Denominator: Debt Ratio 1 Debt ratio Current Year: 1 II % 1 Year Ago: 1 Equity Ratio Choose Numerator: 1 Choose Denominator: / Equity Ratio Equity ratio % Current Year: / 1 Year Ago: 1 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts