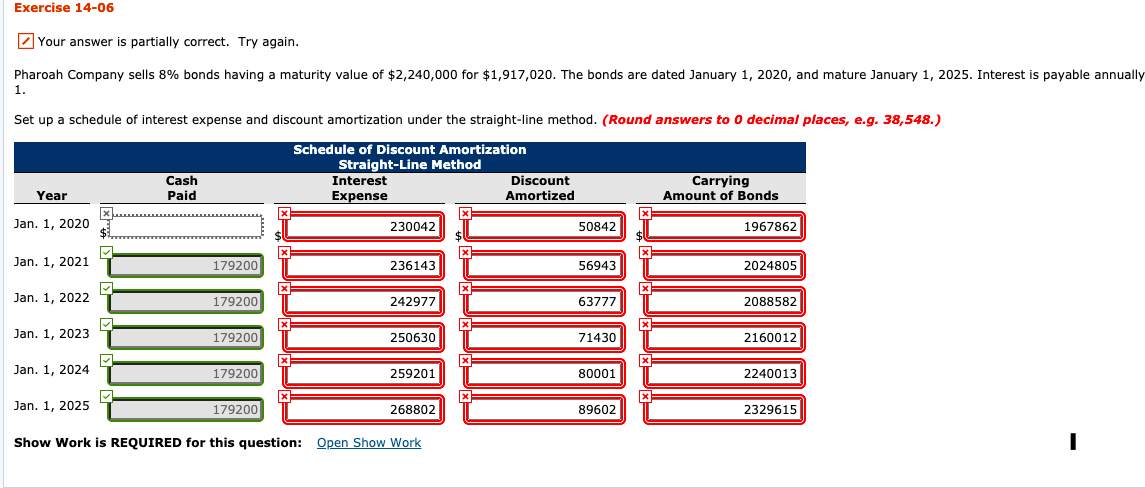

Question: Exercise 14-06 Your answer is partially correct. Try again. Pharoah Company sells 8% bonds having a maturity value of $2,240,000 for $1,917,020. The bonds are

Exercise 14-06 Your answer is partially correct. Try again. Pharoah Company sells 8% bonds having a maturity value of $2,240,000 for $1,917,020. The bonds are dated January 1, 2020, and mature January 1, 2025. Interest is payable annually 1. Set up a schedule of interest expense and discount amortization under the straight-line method. (Round answers to o decimal places, e.g. 38,548.) Schedule of Discount Amortization Straight-Line Method Interest Discount Expense Amortized Cash Paid Carrying Amount of Bonds Year Jan. 1, 2020 230042 50842 1967862 X X Jan. 1, 2021 179200 236143 56943 2024805 x X Jan. 1, 2022 179200 242977 63777 2088582 X X > Jan. 1, 2023 179200 250630 71430 2160012 x X Jan. 1, 2024 179200 259201 80001 2240013 x Jan. 1, 2025 179200 268802 89602 2329615 Show Work is REQUIRED for this question: Open Show Work 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts