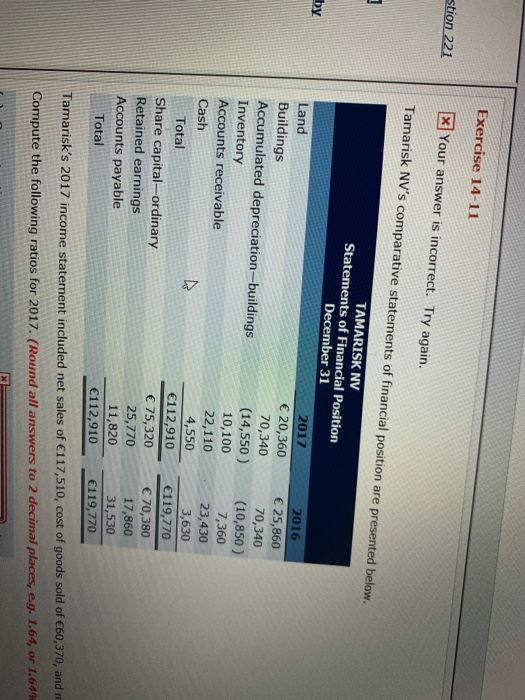

Question: Exercise 14-11 tion 221 x Your answer is incorrect. Try again. Tamarisk NV's comparative statements of financial position are presented below. by TAMARISK NV Statements

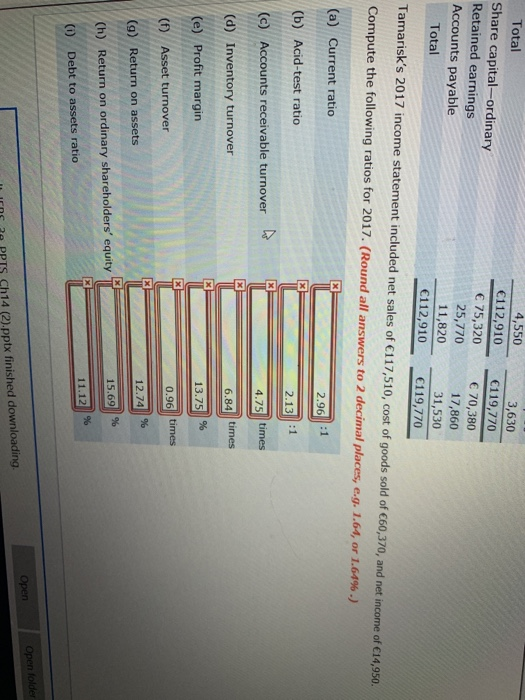

Exercise 14-11 tion 221 x Your answer is incorrect. Try again. Tamarisk NV's comparative statements of financial position are presented below. by TAMARISK NV Statements of Financial Position December 31 2017 Land 20,360 Buildings 70,340 Accumulated depreciation-buildings (14,550 ) Inventory 10,100 Accounts receivable 22,110 Cash 4,550 Total 112,910 Share capital-ordinary 75,320 Retained earnings 25,770 11,820 Accounts payable 112,910 Total 2016 25,860 70,340 (10,850) 7,360 23,430 3,630 119,770 70,380 17,860 31,530 119,770 Tamarisk's 2017 income statement included net sales of 117,510, cost of goods sold of 60,370, and Compute the following ratios for 2017. (Round all answers to 2 decimal places, e.4. 1.64, or 1.64 Total Share capital-ordinary Retained earnings Accounts payable Total 4,5503 ,630 112,910 119,770 75,320 70,380 25,770 17,860 11,820 31,530 112,910 119,770 Tamarisk's 2017 income statement included net sales of 117,510, cost of goods sold of 60,370, and net income of 14,950. Compute the following ratios for 2017. (Round all answers to 2 decimal places, e.g. 1.64, or 1.64%.) (a) Current ratio L 2 .96 -1 (b) Acid-test ratio 1 2 .13 :1 (c) Accounts receivable turnover W 4 4.75 times (d) Inventory turnover 6.84 times (e) Profit margin 13.75 % times () Asset turnover 0.96 X 12.74 (9) Return on assets 15,69 (h) Return on ordinary shareholders' equity 11.12 (0) Debt to assets ratio Open Open folder I P PPTS Ch14 (2).pptx finished downloading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts