Question: Exercise 14-15 (Algorithmic) (LO. 1, 4) Prance, Inc., earned pretax book net income of $1,845,000 in 2020. Prance acquired a depreciable asset that year, and

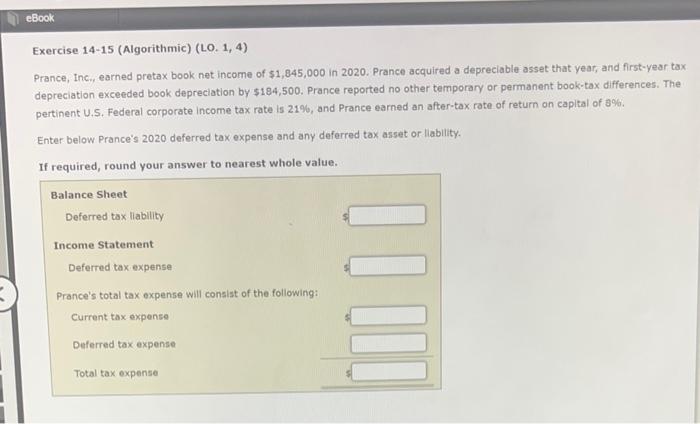

Exercise 14-15 (Algorithmic) (LO. 1, 4) Prance, Inc., earned pretax book net income of $1,845,000 in 2020. Prance acquired a depreciable asset that year, and first-year tax depreciation exceeded book depreciation by $184,500. Prance reported no other termporary or permanent book-tax differences. The pertinent U.5. Federal corporate income tax rate is 21%, and Prance earned an after-tax rate of return on capital of 3%. Enter below Prance's 2020 deferred tax expense and any deferred tax asset or liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts