Question: Exercise 14-18 Your answer is partially correct. Try again On January 1, 2017, Vaughn Co. borrowed and received $517,000 from a major customer evidenced by

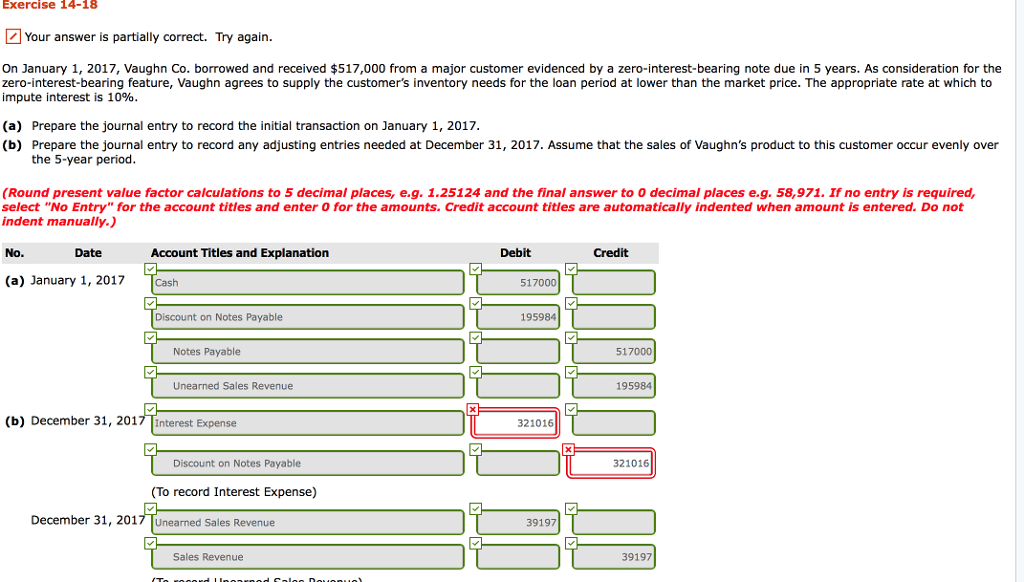

Exercise 14-18 Your answer is partially correct. Try again On January 1, 2017, Vaughn Co. borrowed and received $517,000 from a major customer evidenced by a zero-interest-bearing note due in 5 years. As consideration for the zero-interest-bearing feature, Vaughn agrees to supply the customer's inventory needs for the loan period at lower than the market price. The appropriate rate at which to impute interest is 10% (a) Prepare the journal entry to record the initial transaction on January 1, 2017 (b) Prepare the journal entry to record any adjusting entries needed at December 31, 2017. Assume that the sales of Vaughn's product to this customer occur evenly over the 5-year period (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971. If no entry is required select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No Date Account Titles and Explanation Debit Credit (a) January 1, 2017Cash 517000 Discount on Notes Payable 195984 Notes Payable 517000 Unearned Sales Revenue 195984 (b) December 31, 2017Tinterest Expense 321016 Discount on Notes Payable 321016 (To record Interest Expense) December 31, 2017 TUnearned Sales Revenue 39197 Sales Revenue 39197

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts