Question: Exercise 14-2 (Algo) Net Present Value Analysis (LO14-2] The management of Kunkel Company is considering the purchase of a $41,000 machine that would reduce operating

![Exercise 14-2 (Algo) Net Present Value Analysis (LO14-2] The management of](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67021fe36df0e_48267021fe2dc9d4.jpg)

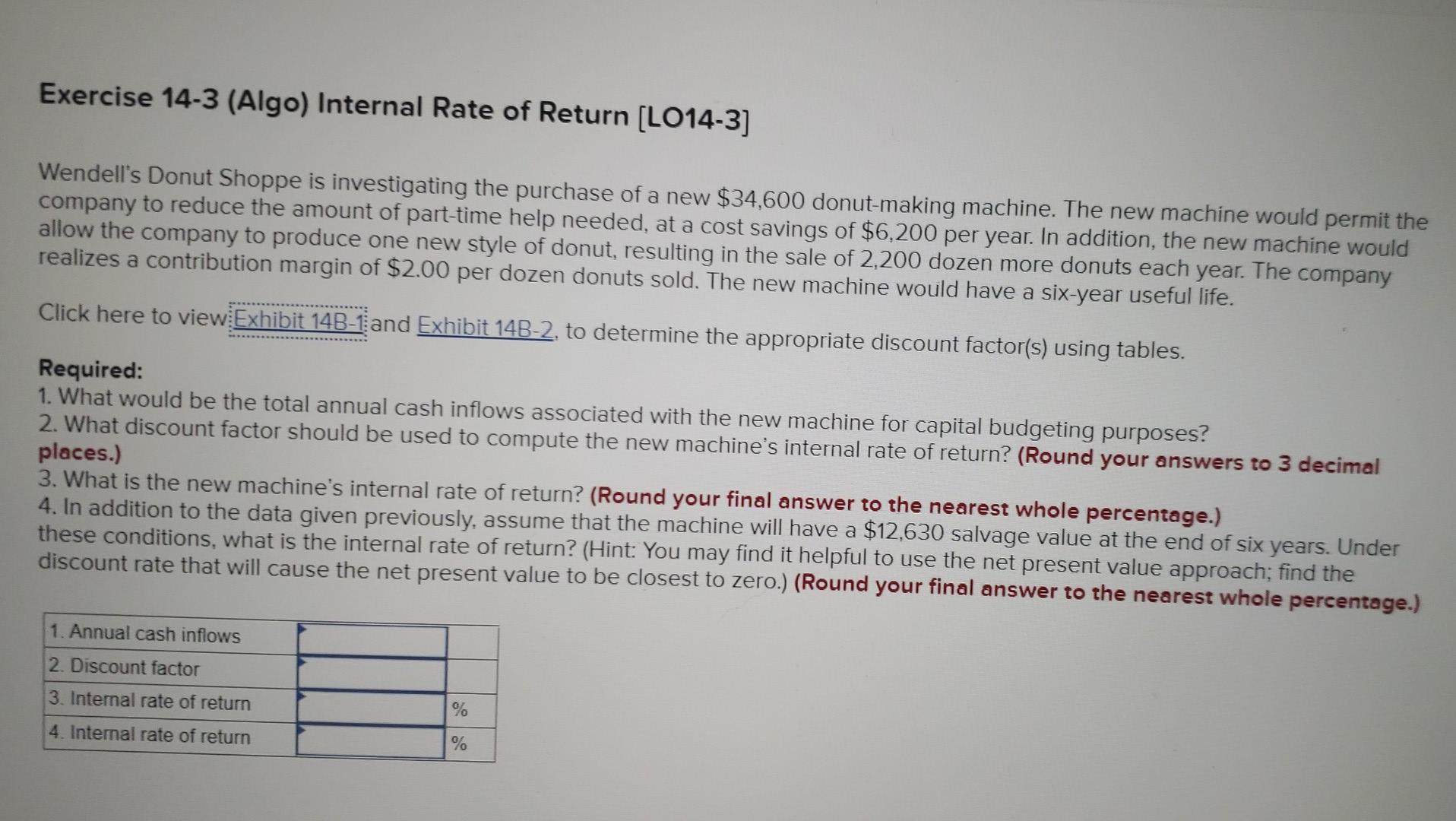

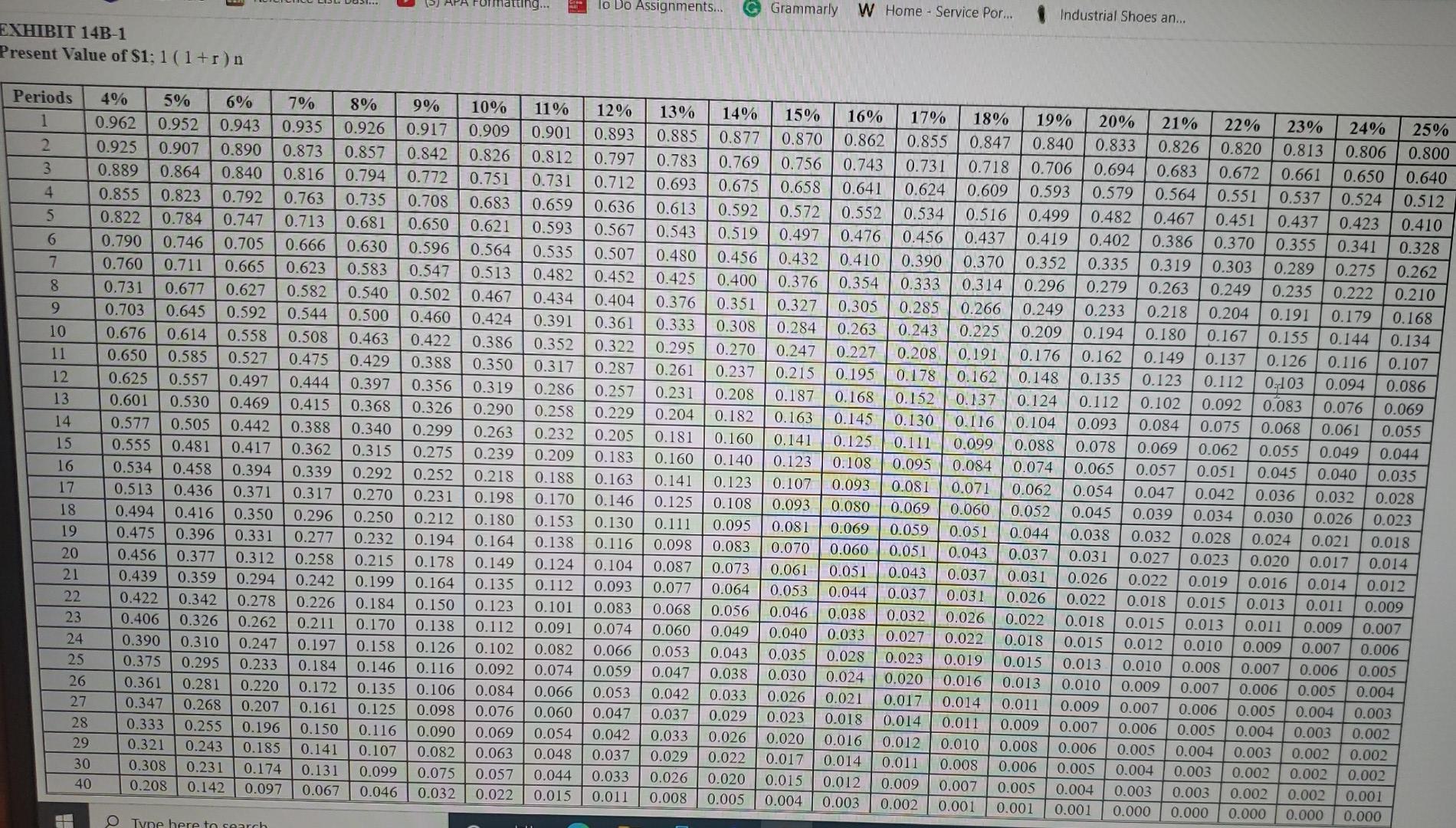

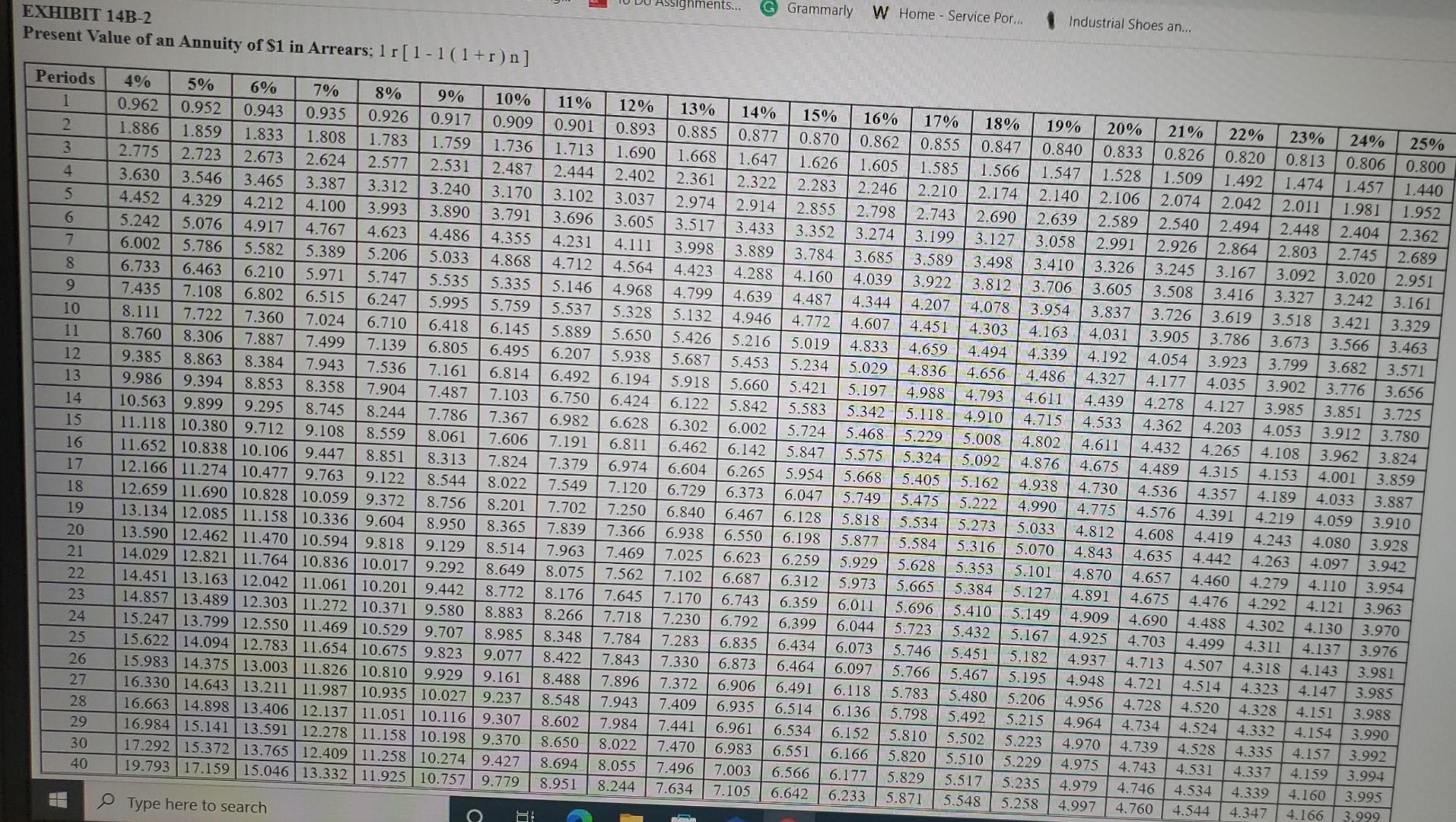

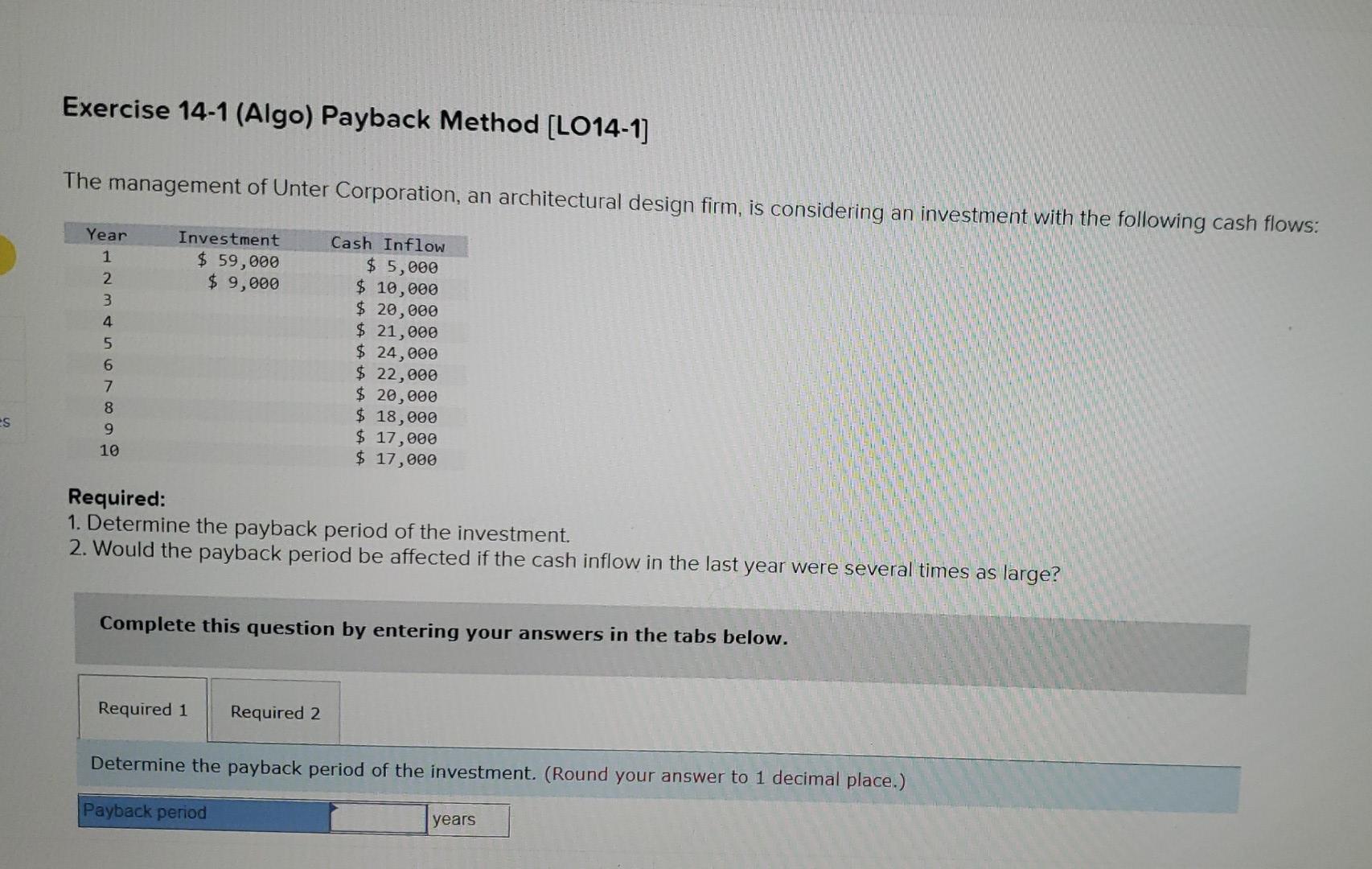

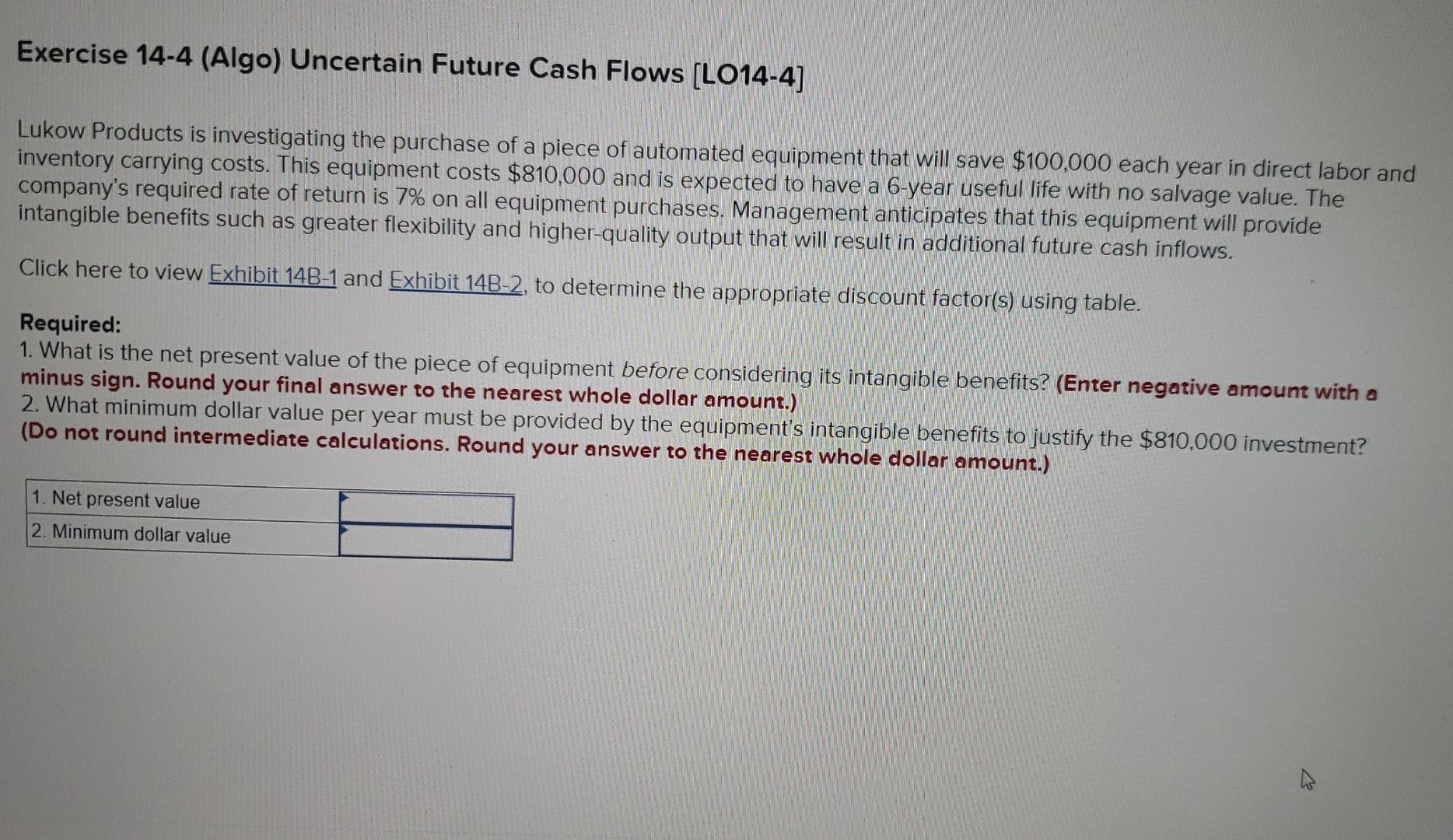

Exercise 14-2 (Algo) Net Present Value Analysis (LO14-2] The management of Kunkel Company is considering the purchase of a $41,000 machine that would reduce operating costs by per year. At the end of the machine's five-year useful life, it will have zero salvage value. The company's required rate of return Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the investment in the machine. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount. Use the appropriate table to determine the discount factor(s).) Net present value Exercise 14-3 (Algo) Internal Rate of Return (LO14-3] Wendell's Donut Shoppe is investigating the purchase of a new $34,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,200 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,200 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 14-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What discount factor should be used to compute the new machine's internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine's internal rate of return? (Round your final answer to the nearest whole percentage.) 4. In addition to the data given previously, assume that the machine will have a $12,630 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your final answer to the nearest whole percentage.) 1. Annual cash inflows 2. Discount factor 3. Internal rate of return % 4. Internal rate of return % Formatting. lo Do Assignments... G Grammarly WHome - Service Por... Industrial Shoes an... EXHIBIT 14B-1 Present Value of $1; 1 (1+r)n Periods 4% 5% 6% 7% 8% 9% 10% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2. 0.925 0.907 0.890 0.873 0.857 0.842 0.826 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 7 0.760 0.711 0.665 0.623 0.583 0.547 0.513 8 0.731 0.677 0.627 0.582 0.540 0.502 0.467 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.650 0.585 0.527 0.475 0.429 0.388 0.350 12 0.625 0.557 0.497 0.444 0.397 0.356 0.319 13 0.601 0.530 0.469 0.415 0.368 0.326 0.290 14 0.577 0.505 0.442 0.388 0.340 0.299 0.263 15 0.555 0.481 0.417 0.362 0.315 0.275 0.239 16 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.494 0.416 0.350 0.296 0.250 0.212 0.180 19 0.475 0.396 0.331 0.277 0.232 0.194 0.164 20 0.456 0.377 0.312 0.258 0.215 0.178 0.149 21 0.439 0.359 0.294 0.242 0.199 0.164 0.135 22 0.422 0.342 0.278 0.226 0.184 0.150 0.123 23 0.406 0.326 0.262 0.211 0.170 0.138 0.112 24 0.390 0.310 0.247 0.197 0.158 0.126 0.102 25 0.375 0.295 0.233 0.184 0.146 0.116 0.092 26 0.361 0.281 0.220 0.172 0.135 0.106 0.084 27 0.347 0.268 0.207 0.161 0.125 0.098 0.076 28 0.333 0.255 0.196 0.150 0.116 0.090 0.069 29 0.321 0.243 0.185 0.141 0.107 0.082 0.063 30 0.308 0.231 0.174 0.131 0.099 0.075 0.057 40 0.208 0.142 0.097 0.067 0.046 0.032 0.022 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.112 0.101 0.091 0.082 0.074 0.066 0.060 0.054 0.048 0.044 0.015 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.093 0.083 0.074 0.066 0.059 0.053 0.047 0.042 0.037 0.033 0.011 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.410 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0.249 0.235 0.222 0.210 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.137 0.126 0.116 0.107 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.055 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.023 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.016 0.014 0.012 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.007 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0.010 0.009 0.007 0.006 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.009 0.007 0.006 0.005 0.004 0.042 0.033 0.026 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.002 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 - + -L ! NO Type here to search Assignments... Grammarly WHome - Service Por... EXHIBIT 14B-2 Present Value of an Annuity of S1 in Arrears; 1 r [1-1(1+r)n] Industrial Shoes an... + 1 TT Periods 4% 5% 6% 7% 8% 9% 10% 11% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 2 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 3 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 4 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 6 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 7 6.002 5.786 5.582 5.389 5.206 5.033 4.8684.712 8 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 9 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 10 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 11 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 12 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 13 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 14 10.563 | 9.899 9.295 8.745 8.244 7.786 7.367 6.982 15 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 16 11.652 10.838 10.106 | 9.447 8.851 8.313 7.824 7.379 17 12.166 11.274 10.4771 9.763 9.122 8.544 8.022 7.549 18 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 19 13.134 | 12.085 11.158 10.336 9.604 8.950 8.365 7.839 20 13.590 12.462 | 11.470 10.594 | 9.818 9.129 8.514 7.963 21 14.029 12.821 | 11.764 10.836 10.017 9.292 8.649 8.075 22 14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 23 14.857 | 13.489 12.303 | 11.272 10.371 9.580 8.883 8.266 24 15.247 | 13.799 | 12.550 11.469 | 10.529 9.707 8.985 8.348 25 15.622 14.094 | 12.783 11.654 10.675 9.823 9.077 8.422 26 15.983 14.375 13.003 11.826 10.8109.929 9.161 8.488 27 16.330 14.643 13.211|11.987 10.935 10.027 | 9.237 8.548 28 16.663 14.898 13.406 12.13711.051 10.116 9.307 8.602 29 16.984 15.141 | 13.591 | 12.278 11.158 10.1989.370 8.650 30 17.292 15.372 13.765 12.409 | 11.258 10.274 | 9.427 8.694 40 19.793 17.159 15.046 13.332 11.925 10.757 | 9.779 8.951 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.562 7.645 7.718 7.784 7.843 7.896 7.943 7.984 8.022 8.055 8.244 13% 14% 0.885 0.877 1.668 1.647 2.361 2.322 2.974 2.914 3.517 3.433 3.998 3.889 4.423 4.288 4.799 4.639 5.132 4.946 5.426 5.216 5.687 5.453 5.918 5.660 6.122 5.842 6.302 6.002 6.462 6.142 6.604 6.265 6.729 6.373 6.840 6.467 6.938 6.550 7.025 6.623 7.102 6.687 7.170 6.743 7.230 6.792 7.283 6.835 7.330 6.873 7.372 6.906 7.409 6.935 7.441 6.961 7.470 6.983 7.496 7.003 7.634 7.105 15% 16% 17% 0.870 0.862 0.855 1.626 1.605 1.585 2.283 2.246 2.210 2.855 2.798 2.743 3.352 3.274 | 3.199 3.784 3.685 3.589 4.160 4.039 3.922 4.487 4.344 4.207 4.772 4.607 4.451 5.019 4.833 4.659 5.234 5.029 4.836 5.421 5.197 4.988 5.583 5.342 5.118 5.724 5.468 5.229 5.847 5.575 5.324 5.954 5.668 5.405 6.047 5.749 5.475 6.128 5.818 5.534 6.198 5.877 5.584 6.259 5.929 5.628 6.312 5.973 5.665 6.359 6.011 5.696 6.399 6.044 5.723 6.434 6.073 5.746 6.464 6.097 5.766 6.491 6.1185.783 6.514 6.136 5.798 6.534 6.152 5.810 6.551 6.166 5.820 6.5666.177 5.829 6.642 6.233 5.871 18% 19% 20% 21% 22% 23% 24% 25% 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.942 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963 5.410 5.149 4.909 4.690 4.488 4.302 4.130 3.970 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.981 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.988 5.492 5.215 4.964 4.7344.524 4.332 4.154 3.990 5.502 5.223 4.970 4.739 4.528 4.335 4.157 3.992 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999 C T H - NO + -TT D + L Type here to search C Exercise 14-1 (Algo) Payback Method [LO14-1] The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year 1 2 3 4 Investment $ 59,000 $ 9,000 5 6 7 8 9 10 Cash Inflow $ 5,000 $ 10,000 $ 20,000 $ 21,000 $ 24,000 $ 22,000 $ 20,000 $ 18,000 $ 17,000 $ 17,000 es Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the payback period of the investment. (Round your answer to 1 decimal place.) Payback period years Exercise 14-4 (Algo) Uncertain Future Cash Flows (LO14-4] Lukow Products is investigating the purchase of a piece of automated equipment that will save $100,000 each year in direct labor and inventory carrying costs. This equipment costs $810,000 and is expected to have a 6-year useful life with no salvage value. The company's required rate of return is 7% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $810,000 investment? (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) 1. Net present value 2. Minimum dollar value Exercise 14-2 (Algo) Net Present Value Analysis (LO14-2] The management of Kunkel Company is considering the purchase of a $41,000 machine that would reduce operating costs by per year. At the end of the machine's five-year useful life, it will have zero salvage value. The company's required rate of return Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the net present value of the investment in the machine. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount. Use the appropriate table to determine the discount factor(s).) Net present value Exercise 14-3 (Algo) Internal Rate of Return (LO14-3] Wendell's Donut Shoppe is investigating the purchase of a new $34,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $6,200 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,200 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life. Click here to view Exhibit 14-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What discount factor should be used to compute the new machine's internal rate of return? (Round your answers to 3 decimal places.) 3. What is the new machine's internal rate of return? (Round your final answer to the nearest whole percentage.) 4. In addition to the data given previously, assume that the machine will have a $12,630 salvage value at the end of six years. Under these conditions, what is the internal rate of return? (Hint: You may find it helpful to use the net present value approach; find the discount rate that will cause the net present value to be closest to zero.) (Round your final answer to the nearest whole percentage.) 1. Annual cash inflows 2. Discount factor 3. Internal rate of return % 4. Internal rate of return % Formatting. lo Do Assignments... G Grammarly WHome - Service Por... Industrial Shoes an... EXHIBIT 14B-1 Present Value of $1; 1 (1+r)n Periods 4% 5% 6% 7% 8% 9% 10% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 2. 0.925 0.907 0.890 0.873 0.857 0.842 0.826 3 0.889 0.864 0.840 0.816 0.794 0.772 0.751 4 0.855 0.823 0.792 0.763 0.735 0.708 0.683 5 0.822 0.784 0.747 0.713 0.681 0.650 0.621 6 0.790 0.746 0.705 0.666 0.630 0.596 0.564 7 0.760 0.711 0.665 0.623 0.583 0.547 0.513 8 0.731 0.677 0.627 0.582 0.540 0.502 0.467 9 0.703 0.645 0.592 0.544 0.500 0.460 0.424 10 0.676 0.614 0.558 0.508 0.463 0.422 0.386 11 0.650 0.585 0.527 0.475 0.429 0.388 0.350 12 0.625 0.557 0.497 0.444 0.397 0.356 0.319 13 0.601 0.530 0.469 0.415 0.368 0.326 0.290 14 0.577 0.505 0.442 0.388 0.340 0.299 0.263 15 0.555 0.481 0.417 0.362 0.315 0.275 0.239 16 0.534 0.458 0.394 0.339 0.292 0.252 0.218 17 0.513 0.436 0.371 0.317 0.270 0.231 0.198 18 0.494 0.416 0.350 0.296 0.250 0.212 0.180 19 0.475 0.396 0.331 0.277 0.232 0.194 0.164 20 0.456 0.377 0.312 0.258 0.215 0.178 0.149 21 0.439 0.359 0.294 0.242 0.199 0.164 0.135 22 0.422 0.342 0.278 0.226 0.184 0.150 0.123 23 0.406 0.326 0.262 0.211 0.170 0.138 0.112 24 0.390 0.310 0.247 0.197 0.158 0.126 0.102 25 0.375 0.295 0.233 0.184 0.146 0.116 0.092 26 0.361 0.281 0.220 0.172 0.135 0.106 0.084 27 0.347 0.268 0.207 0.161 0.125 0.098 0.076 28 0.333 0.255 0.196 0.150 0.116 0.090 0.069 29 0.321 0.243 0.185 0.141 0.107 0.082 0.063 30 0.308 0.231 0.174 0.131 0.099 0.075 0.057 40 0.208 0.142 0.097 0.067 0.046 0.032 0.022 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 0.112 0.101 0.091 0.082 0.074 0.066 0.060 0.054 0.048 0.044 0.015 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.093 0.083 0.074 0.066 0.059 0.053 0.047 0.042 0.037 0.033 0.011 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.410 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0.249 0.235 0.222 0.210 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.137 0.126 0.116 0.107 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.055 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.023 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.016 0.014 0.012 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.007 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0.010 0.009 0.007 0.006 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.009 0.007 0.006 0.005 0.004 0.042 0.033 0.026 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.002 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 - + -L ! NO Type here to search Assignments... Grammarly WHome - Service Por... EXHIBIT 14B-2 Present Value of an Annuity of S1 in Arrears; 1 r [1-1(1+r)n] Industrial Shoes an... + 1 TT Periods 4% 5% 6% 7% 8% 9% 10% 11% 1 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 2 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 3 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 4 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 5 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 6 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 7 6.002 5.786 5.582 5.389 5.206 5.033 4.8684.712 8 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 9 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 10 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 11 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 12 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 13 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 14 10.563 | 9.899 9.295 8.745 8.244 7.786 7.367 6.982 15 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 16 11.652 10.838 10.106 | 9.447 8.851 8.313 7.824 7.379 17 12.166 11.274 10.4771 9.763 9.122 8.544 8.022 7.549 18 12.659 11.690 10.828 10.059 9.372 8.756 8.201 7.702 19 13.134 | 12.085 11.158 10.336 9.604 8.950 8.365 7.839 20 13.590 12.462 | 11.470 10.594 | 9.818 9.129 8.514 7.963 21 14.029 12.821 | 11.764 10.836 10.017 9.292 8.649 8.075 22 14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 23 14.857 | 13.489 12.303 | 11.272 10.371 9.580 8.883 8.266 24 15.247 | 13.799 | 12.550 11.469 | 10.529 9.707 8.985 8.348 25 15.622 14.094 | 12.783 11.654 10.675 9.823 9.077 8.422 26 15.983 14.375 13.003 11.826 10.8109.929 9.161 8.488 27 16.330 14.643 13.211|11.987 10.935 10.027 | 9.237 8.548 28 16.663 14.898 13.406 12.13711.051 10.116 9.307 8.602 29 16.984 15.141 | 13.591 | 12.278 11.158 10.1989.370 8.650 30 17.292 15.372 13.765 12.409 | 11.258 10.274 | 9.427 8.694 40 19.793 17.159 15.046 13.332 11.925 10.757 | 9.779 8.951 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.562 7.645 7.718 7.784 7.843 7.896 7.943 7.984 8.022 8.055 8.244 13% 14% 0.885 0.877 1.668 1.647 2.361 2.322 2.974 2.914 3.517 3.433 3.998 3.889 4.423 4.288 4.799 4.639 5.132 4.946 5.426 5.216 5.687 5.453 5.918 5.660 6.122 5.842 6.302 6.002 6.462 6.142 6.604 6.265 6.729 6.373 6.840 6.467 6.938 6.550 7.025 6.623 7.102 6.687 7.170 6.743 7.230 6.792 7.283 6.835 7.330 6.873 7.372 6.906 7.409 6.935 7.441 6.961 7.470 6.983 7.496 7.003 7.634 7.105 15% 16% 17% 0.870 0.862 0.855 1.626 1.605 1.585 2.283 2.246 2.210 2.855 2.798 2.743 3.352 3.274 | 3.199 3.784 3.685 3.589 4.160 4.039 3.922 4.487 4.344 4.207 4.772 4.607 4.451 5.019 4.833 4.659 5.234 5.029 4.836 5.421 5.197 4.988 5.583 5.342 5.118 5.724 5.468 5.229 5.847 5.575 5.324 5.954 5.668 5.405 6.047 5.749 5.475 6.128 5.818 5.534 6.198 5.877 5.584 6.259 5.929 5.628 6.312 5.973 5.665 6.359 6.011 5.696 6.399 6.044 5.723 6.434 6.073 5.746 6.464 6.097 5.766 6.491 6.1185.783 6.514 6.136 5.798 6.534 6.152 5.810 6.551 6.166 5.820 6.5666.177 5.829 6.642 6.233 5.871 18% 19% 20% 21% 22% 23% 24% 25% 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.362 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.951 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.571 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.780 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.942 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963 5.410 5.149 4.909 4.690 4.488 4.302 4.130 3.970 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.981 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.985 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.988 5.492 5.215 4.964 4.7344.524 4.332 4.154 3.990 5.502 5.223 4.970 4.739 4.528 4.335 4.157 3.992 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999 C T H - NO + -TT D + L Type here to search C Exercise 14-1 (Algo) Payback Method [LO14-1] The management of Unter Corporation, an architectural design firm, is considering an investment with the following cash flows: Year 1 2 3 4 Investment $ 59,000 $ 9,000 5 6 7 8 9 10 Cash Inflow $ 5,000 $ 10,000 $ 20,000 $ 21,000 $ 24,000 $ 22,000 $ 20,000 $ 18,000 $ 17,000 $ 17,000 es Required: 1. Determine the payback period of the investment. 2. Would the payback period be affected if the cash inflow in the last year were several times as large? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the payback period of the investment. (Round your answer to 1 decimal place.) Payback period years Exercise 14-4 (Algo) Uncertain Future Cash Flows (LO14-4] Lukow Products is investigating the purchase of a piece of automated equipment that will save $100,000 each year in direct labor and inventory carrying costs. This equipment costs $810,000 and is expected to have a 6-year useful life with no salvage value. The company's required rate of return is 7% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $810,000 investment? (Do not round intermediate calculations. Round your answer to the nearest whole dollar amount.) 1. Net present value 2. Minimum dollar value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts