Question: Exercise 14-23 (Algorithmic) (LO. 5) In its books, Ion Corporation reports income tax expense and income tax payable of $172,960 and $216,200, respectively. Assume that

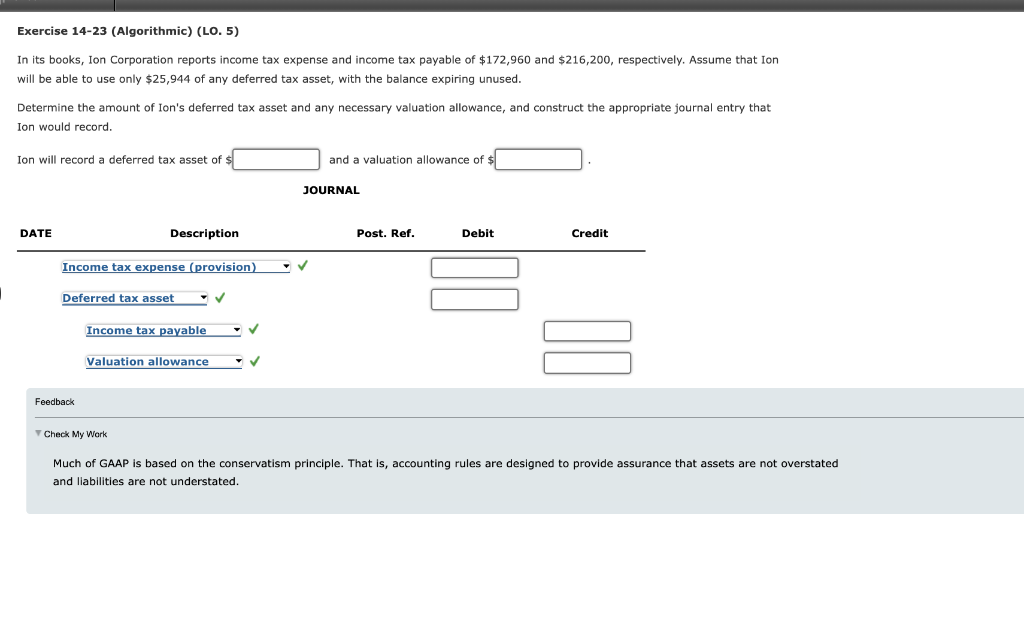

Exercise 14-23 (Algorithmic) (LO. 5) In its books, Ion Corporation reports income tax expense and income tax payable of $172,960 and $216,200, respectively. Assume that Ion will be able to use only $25,944 of any deferred tax asset, with the balance expiring unused. Determine the amount of Ion's deferred tax asset and any necessary valuation allowance, and construct the appropriate journal entry that Ion would record. Ion will record a deferred tax asset of $ and a valuation allowance of JOURNAL DATE Description Post. Ref. Debit Credit Income tax expense (provision) Deferred tax asset Income tax payable IO Valuation allowance Feedback Check My Work Much AAP is based on the conservatism principle. That is, accounting rules are designed to provide assurance that assets are not overstated and liabilities are not understated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts