Question: Exercise 14-27 Your answer is partially correct. Try again. Pearl Corp. owes $251,000 to Martinez Trust. The debt is a 10-year, 12% note due December

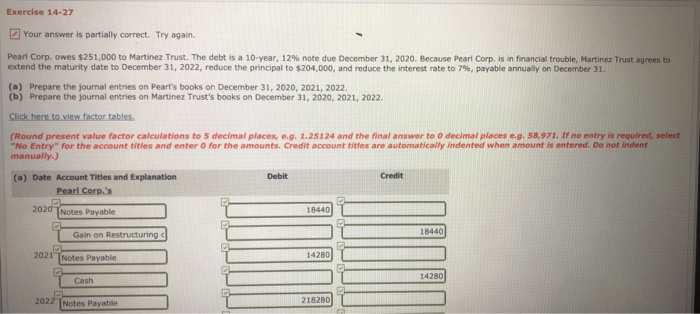

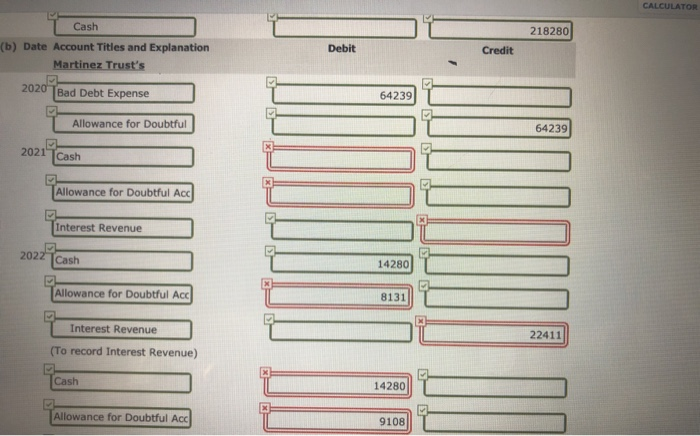

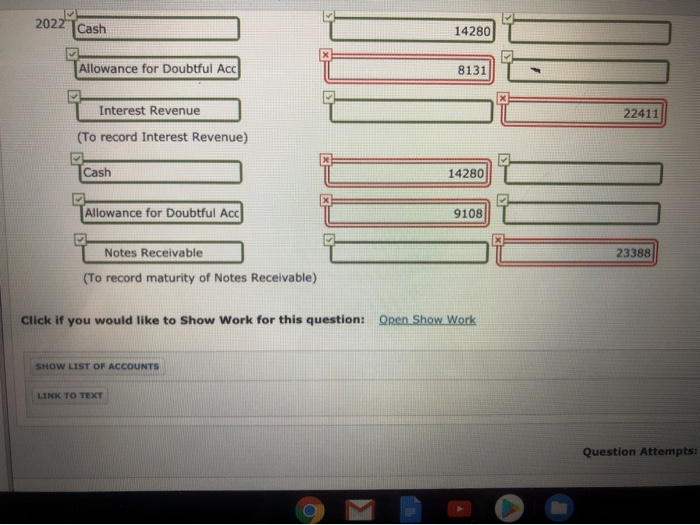

Exercise 14-27 Your answer is partially correct. Try again. Pearl Corp. owes $251,000 to Martinez Trust. The debt is a 10-year, 12% note due December 31, 2020. Because Pearl Corp. is in financial trouble, Martinez Trust agrees to extend the maturity date to December 31, 2022, reduce the principal to $204,000, and reduce the interest rate to 7%, payable annually on December 31. (a) Prepare the journal entries on Pearl's books on December 31, 2020, 2021, 2022. (b) Prepare the journal entries on Martinez Trust's books on December 31, 2020, 2021, 2022. Click here to view factor tables. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,971. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) (a) Date Account Titles and Explanation Debit Credit Pearl Corp.'s 2020 Notes Payable 18440 Gain on Restructuring 18440 2021 Notes Payable 14280 Cash 14280 2022 Notes Payable 218280 2 CALCULATOR Cash 218280 Debit (b) Date Account Titles and Explanation Martinez Trust's Credit 2020 Bad Debt Expense 64239 Allowance for Doubtful 64239 2021 Cash Allowance for Doubtful Acc Interest Revenue 2022 Cash 14280 Allowance for Doubtful Acc 8131 Interest Revenue 22411 (To record Interest Revenue) Cash 14280 Allowance for Doubtful Acc 9108 2022 Cash 14280 Allowance for Doubtful Acc 8131 Interest Revenue 22411 (To record Interest Revenue) Cash 14280 Allowance for Doubtful Acc 9108 Notes Receivable 23388 (To record maturity of Notes Receivable) Click if you would like to Show Work for this question: Oren Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Question Attempts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts