Question: Exercise 14-32 (Static) Accrued interest (Appendix 14A) On March 1, 2021, Brown-Ferring Corporation issued $100 million of 12% bonds, dated January 1, 2021, for $99

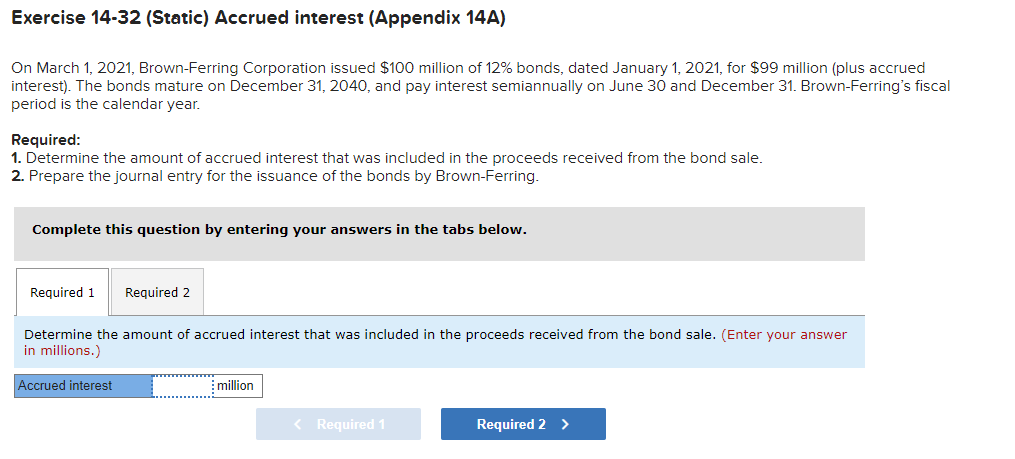

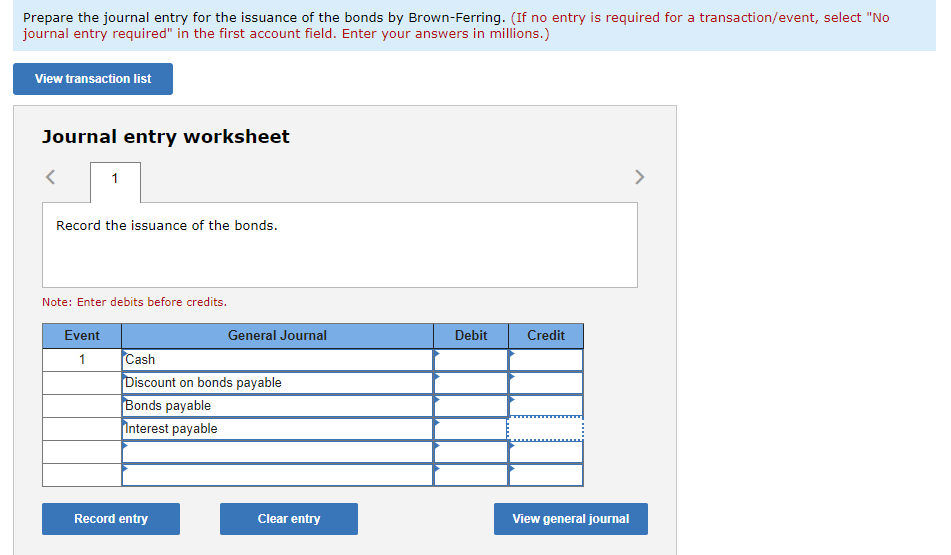

Exercise 14-32 (Static) Accrued interest (Appendix 14A) On March 1, 2021, Brown-Ferring Corporation issued $100 million of 12% bonds, dated January 1, 2021, for $99 million (plus accrued interest). The bonds mature on December 31, 2040, and pay interest semiannually on June 30 and December 31. Brown-Ferring's fiscal period is the calendar year. Required: 1. Determine the amount of accrued interest that was included in the proceeds received from the bond sale. 2. Prepare the journal entry for the issuance of the bonds by Brown-Ferring. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the amount of accrued interest that was included in the proceeds received from the bond sale. (Enter your answer in millions.) Accrued interest million Required 1 Required 2 > Prepare the journal entry for the issuance of the bonds by Brown-Ferring. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions.) View transaction list Journal entry worksheet 1 > Record the issuance of the bonds. Note: Enter debits before credits. Debit Credit Event 1 General Journal Cash Discount on bonds payable Bonds payable Interest payable Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts