Question: Exercise 14.37 Data are given below on the adjusted gross income x and the amount of itemized deductions taken by taxpayers. Data were reported in

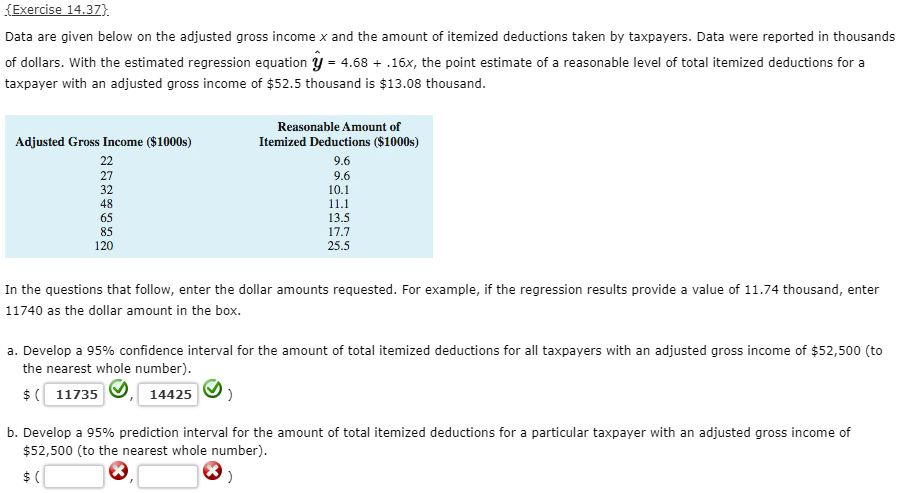

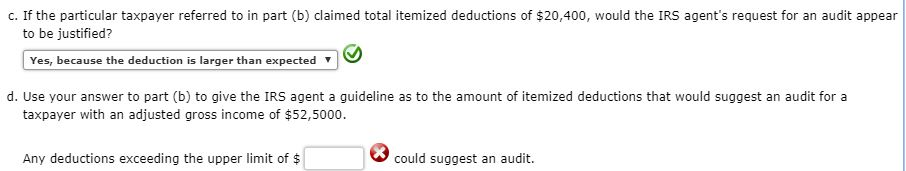

Exercise 14.37 Data are given below on the adjusted gross income x and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the estimated regression equation y 4.6816x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52.5 thousand is $13.08 thousand. Reasonable Amount of Adjusted Gross Income ($1000s) Itemized Deductions ($1000s) 9.6 22 27 9.6 32 10.1 48 11.1 65 13.5 17.7 120 25.5 In the questions that follow, enter the dollar amounts requested. For example, if the regression results provide a value of 11.74 thousand, enter 11740 as the dollar amount in the box. a. Develop a 95% confidence interval for the amount of total itemized deductions for all taxpayers with an adjusted gross income of $52,500 (to the nearest whole number) $11735 14425 b. Develop a 95% prediction interval for the amount of total itemized deductions for a particular taxpayer with an adjusted gross income of $52,500 (to the nearest whole number) c. If the particular taxpayer referred to in part (b) claimed total itemized deductions of $20,400, would the IRS agent's request for an audit appear to be justified? Yes, because the deduction is larger than expected d. Use your answer to part (b) to give the IRS agent a guideline as to the amount of itemized deductions that would suggest an audit fora taxpayer with an adjusted gross income of $52,5000. Any deductions exceeding the upper limit of $ could suggest an audit. Exercise 14.37 Data are given below on the adjusted gross income x and the amount of itemized deductions taken by taxpayers. Data were reported in thousands of dollars. With the estimated regression equation y 4.6816x, the point estimate of a reasonable level of total itemized deductions for a taxpayer with an adjusted gross income of $52.5 thousand is $13.08 thousand. Reasonable Amount of Adjusted Gross Income ($1000s) Itemized Deductions ($1000s) 9.6 22 27 9.6 32 10.1 48 11.1 65 13.5 17.7 120 25.5 In the questions that follow, enter the dollar amounts requested. For example, if the regression results provide a value of 11.74 thousand, enter 11740 as the dollar amount in the box. a. Develop a 95% confidence interval for the amount of total itemized deductions for all taxpayers with an adjusted gross income of $52,500 (to the nearest whole number) $11735 14425 b. Develop a 95% prediction interval for the amount of total itemized deductions for a particular taxpayer with an adjusted gross income of $52,500 (to the nearest whole number) c. If the particular taxpayer referred to in part (b) claimed total itemized deductions of $20,400, would the IRS agent's request for an audit appear to be justified? Yes, because the deduction is larger than expected d. Use your answer to part (b) to give the IRS agent a guideline as to the amount of itemized deductions that would suggest an audit fora taxpayer with an adjusted gross income of $52,5000. Any deductions exceeding the upper limit of $ could suggest an audit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts