Question: Exercise 14-6 (Static) Classifying product and period costs LO C2 A car manufacturer incurs the following costs. Classify each cost as either a product or

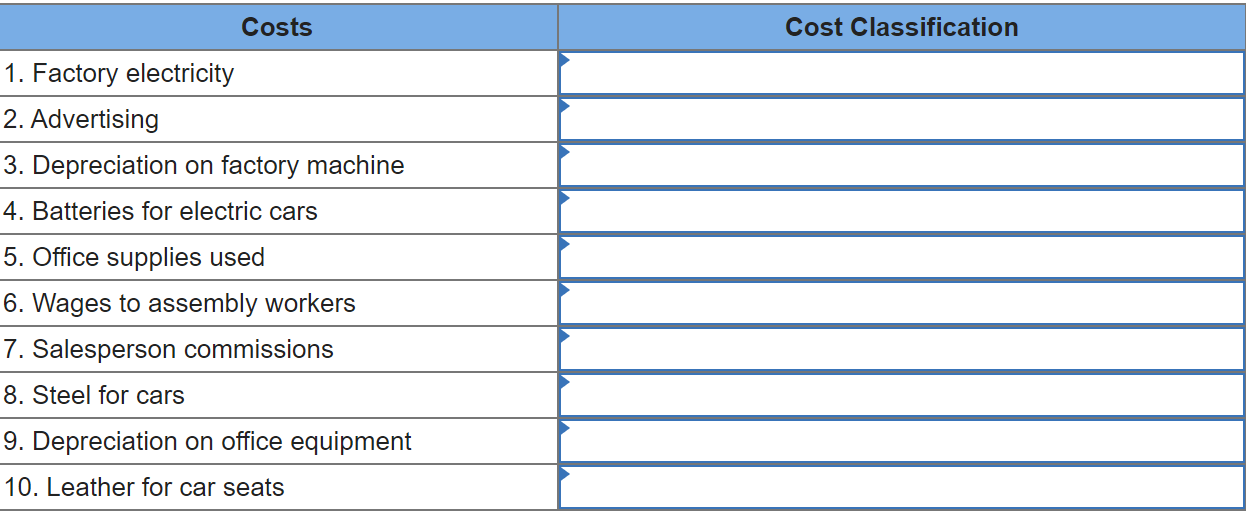

Exercise 14-6 (Static) Classifying product and period costs LO C2 A car manufacturer incurs the following costs. Classify each cost as either a product or period cost. If a product cost, classify it as direct materials, direct labor, or factory overhead. If a period cost, classify it as a selling expense or a general and administrative expense.

\begin{tabular}{l} \multicolumn{1}{c}{ Costs } \\ 1. Factory electricity \\ 2. Advertising \\ 3. Depreciation on factory machine \\ 4. Batteries for electric cars \\ \hline 5. Office supplies used \\ 6. Wages to assembly workers \\ 7. Salesperson commissions \\ 8. Steel for cars \\ 9. Depreciation on office equipment \\ 10. Leather for car seats \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts