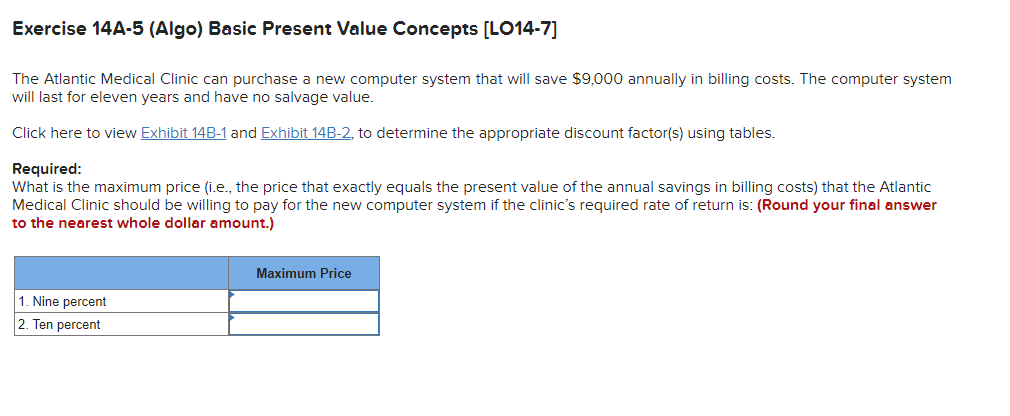

Question: Exercise 14A-5 (Algo) Basic Present Value Concepts [LO14-7] The Atlantic Medical Clinic can purchase a new computer system that will save $9,000 annually in billing

![Exercise 14A-5 (Algo) Basic Present Value Concepts [LO14-7] The Atlantic Medical](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e865f915733_48866e865f8aa830.jpg)

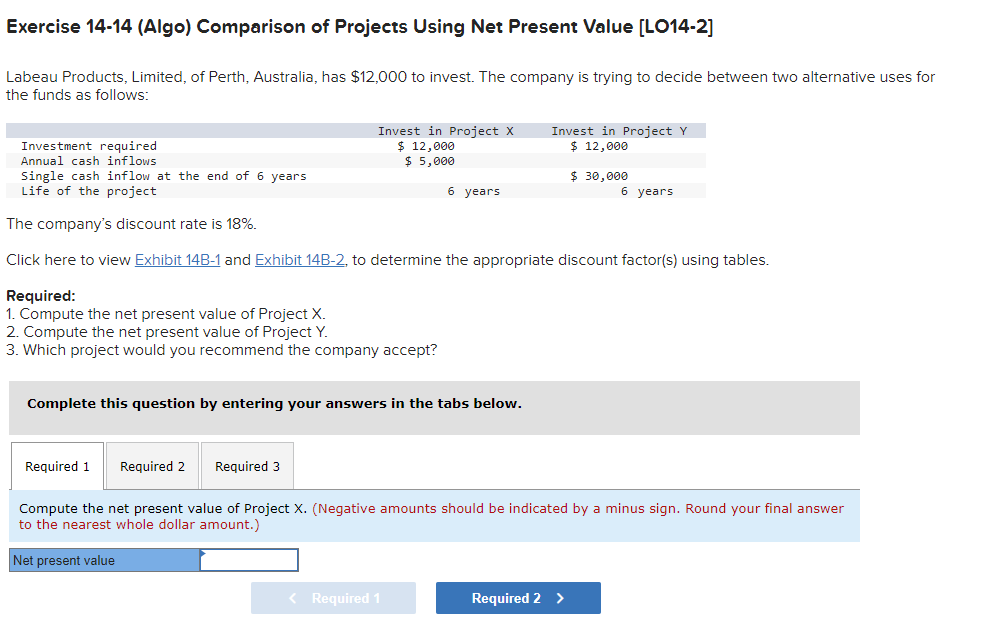

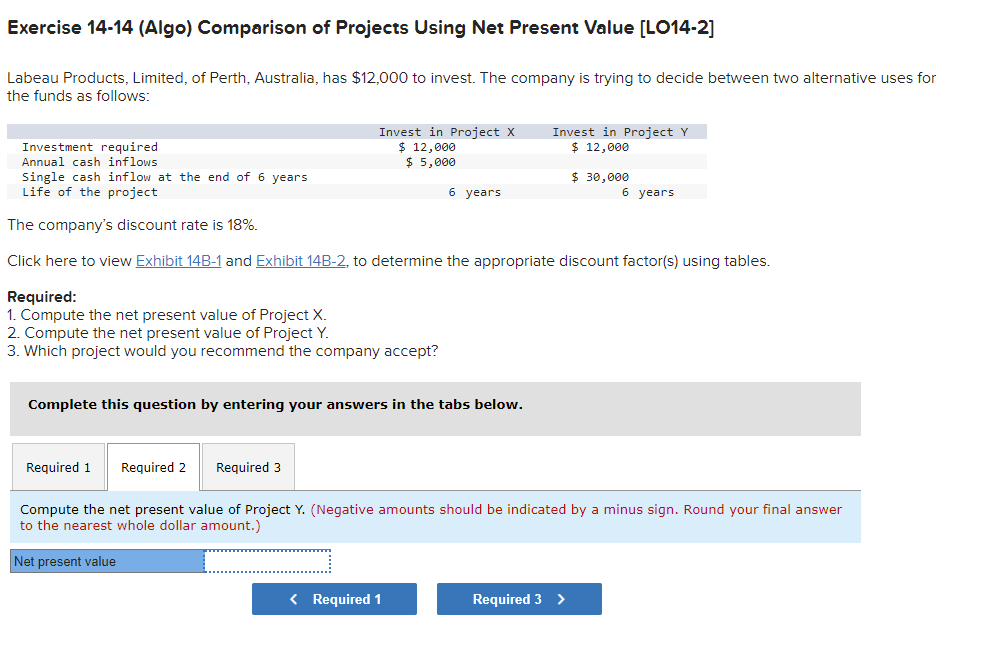

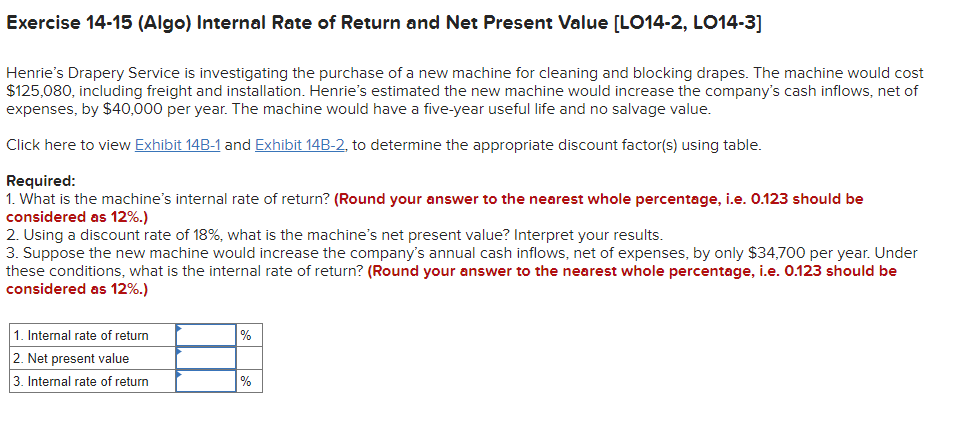

Exercise 14A-5 (Algo) Basic Present Value Concepts [LO14-7] The Atlantic Medical Clinic can purchase a new computer system that will save $9,000 annually in billing costs. The computer system will last for eleven years and have no salvage value. Click here to view and to determine the appropriate discount factor(s) using tables. Required: What is the maximum price (i.e., the price that exactly equals the present value of the annual savings in billing costs) that the Atlantic Medical Clinic should be willing to pay for the new computer system if the clinic's required rate of return is: (Round your final answer to the nearest whole dollar amount.) Exercise 14-14 (Algo) Comparison of Projects Using Net Present Value [LO14-2] Labeau Products, Limited, of Perth, Australia, has $12,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: The company's discount rate is 18%. Click here to view and to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project X. 2. Compute the net present value of Project Y. 3. Which project would you recommend the company accept? Complete this question by entering your answers in the tabs below. Compute the net present value of Project X. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.) Exercise 14A-1 (Algo) Basic Present Value Concepts [LO14-7] Annual cash inflows that will arise from two competing investment projects are given below: The discount rate is 12%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: Compute the present value of the cash inflows for each investment. Exercise 14-14 (Algo) Comparison of Projects Using Net Present Value [LO14-2] Labeau Products, Limited, of Perth, Australia, has $12,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: The company's discount rate is 18%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net present value of Project X. 2. Compute the net present value of Project Y. 3. Which project would you recommend the company accept? Complete this question by entering your answers in the tabs below. Compute the net present value of Project Y. (Negative amounts should be indicated by a minus sign. Round your final answer to the nearest whole dollar amount.) Exercise 14-15 (Algo) Internal Rate of Return and Net Present Value [LO14-2, LO14-3] Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $125,080, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $40,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view and to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 2. Using a discount rate of 18%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $34,700 per year. Under these conditions, what is the internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts